In our experience, the world of software roadmaps often feels disconnected from the real needs of government customers. But what if it didn’t have to be that way? What if you, as a government professional, could actively shape the future of the tools you rely on? That’s our vision.

As a customer-centric organization, FreeBalance does not impose roadmaps on customers. Instead, we have created the FreeBalance International Steering Committee (FISC) so that our government customers are actively involved in shaping our roadmap. At FISC, we explore and innovate with our clients, and unlike other commercial vendors, FreeBalance augments products to meet contractual obligations – no code customization outside the product; no unsupported code.

Instead, our philosophy is rooted in the understanding that improving public finances is a shared journey; we are co-explorers and co-innovators with our government clients. Public financial management (PFM) serves as our “north star”.

FreeBalance customers shape our future

We have expectations at FISC: government customers take an active role rather than act as passive recipients of a pre-determined roadmap. Customers refine the product roadmap, reprioritizing and adding new items to ensure that we meet what they need on the ground. This ensures that the roadmap aligns with specific needs, preventing the “cliff of bad options” that can arise when vendor roadmaps diverge from government realities.

Customers vote on product roadmap priorities on the last day of FISC: April 10, 2025 in Dili, Timor-Leste.

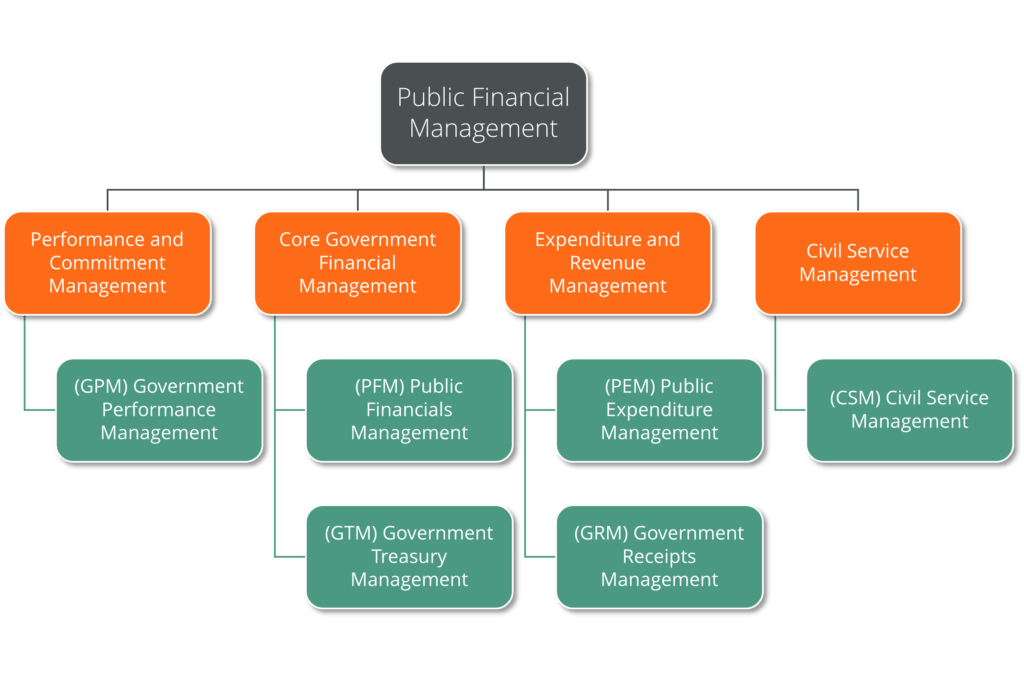

Composante de la gestion des finances publiques (carte)

At the heart of our offering is the Public Financial Management Component Map (PFMCM), currently in version 4.24 . This map, first developed in 2008, provides a structured overview of all possible public finance functions. The PFMCM consists of 6 pillars, 33 functions (similar to large software modules), and 546 components . These pillars encompass key areas, or pillars, of public financial management:

- Gestion de la performance des administrations publiques

- Core public financials management

- Government treasury management

- Public expenditure management

- Government receipts management

- Gestion de la fonction publique

The PFM Component Map enables the determination of functional needs and priorities for effective Public Financial Management, and provides a high level view of government financial functions.

- Les Gestion de la fonction publique (CSM) pillar provides public sector capital management including:

- public service planning, forecasting and budgeting

- payroll, pensions, time and attendance

- workforce management with recruitment, assignments, promotions, leaving, and retirement

- performance, training, succession, and talent management; public service asset disclosure, salary and expenditures transparency

- e-recruitment.

- Les Gestion des performances des administrations publiques (GPM) pillar provides budget and performance functions such as:

- multiple year policy and budget planning

- budget and performance classifications

- forecasting, analytics, dashboards and scorecards, compliance and audit management

- fiscal transparency portals and access to information management.

- Les Gestion des recettes publiques (GRM) pillar provides government revenue functions including:

- property, sales, VAT, inheritance, customs, excise, and income tax administration

- cashiering, permits, licenses, and billing non-tax revenue

- asset disposal and government commercial sales

- government e-commerce and e-filing.

- Les Gestion de la trésorerie publique (GTM) pillar provides government treasury functions such as:

- les paiements et les rapprochements bancaires

- cash and liquidity management; debt, grant, and aid management

- investissements financiers et fonds souverains

- treasury single account.

- Les Gestion des dépenses publiques (PEM) pillar provides government spending functions including:

- purchasing, procurement, and contract management

- grants and social programs

- e-procurement, e-grants, and e-benefits.

- Les Gestion des finances publiques (GFP) pillar includes core government fiscal functions such as:

- comptabilité et rapports

- les normes nationales et internationales du secteur public

- commitment accounting budget execution, budget and commitment controls

- actifs et stocks

- la comptabilité analytique et de projet.

Read more about the PFM Component Map in our Minister Briefing.