FreeBalance International Steering Committee (FISC) 2025 Session Overview

FISC 2025, hosted by the Government of Timor-Leste, kicked off on Sunday with an opening ceremony attended by the Prime Minister of the IX Constitutional Government of Timor-Leste, Kay Rala Xanana Gusmão, Minister of Finance, Santina José Rodrigues F. Viegas Cardoso, and a number of Ministers and Officials from the Government.

The key FISC session on national development strategies and aligned government performance management was hosted by FreeBalance President and CEO, Manuel Schiappa Pietra, assisted by Executive Vice President for Strategy and Innovation, Doug Hadden. We described our public finance learning journey – a journey driven by our government customers and the global Public Financial Management (PFM) community.

From Accounting to Accountability: A Journey Towards Public Finance Success

Imagine a world where government spending is directly linked to national priorities and financial systems drive measurable progress. We explored our journey to this vision starting with.the fundamental question: “What is public finance success?”

Our conclusion: Results. Outcomes. Far more than managing government budgeting.

Our realization through customer engagement, as a customer-centric firm, is that public finance is transforming “from spending control to measurable impact”. This transformation is encapsulated in the phrase: “From accounting to accountability, from spending to strategy” .

This journey started in 2006 with strategic planning, prompting the question of why governments were choosing FreeBalance software, Our team told us that we succeeded because our software was “build for government”. The FreeBalance Accountability Suite™ was Planejamento de Recursos Governamentais (GRP). Why did this matter given the market presence of large Enterprise Resource Planning (ERP) vendors? Although originally designed for private sector needs, these products had expanded to other “industry verticals”, including government.

What did “built for government” really mean?

- Support for commitment accounting and controls across budget cycles with complex classifications and rules

- Configurability to accelerate time to results and support progressive activation for future reform and modernization

- Acessibilidade, with full implementation prices averaging about half those of ERP alternatives.

Our session highlighted that our understanding at FreeBalance came when the term “public financial management” was used. PFM in government is mission-critical, as without it, there can be no spending on priorities, and budgets are the law. Unlike business ERP which focuses on mission-critical areas supported by financial management, public finance é mission-critical in government, covering all spending, public investments, budgets, and priorities.

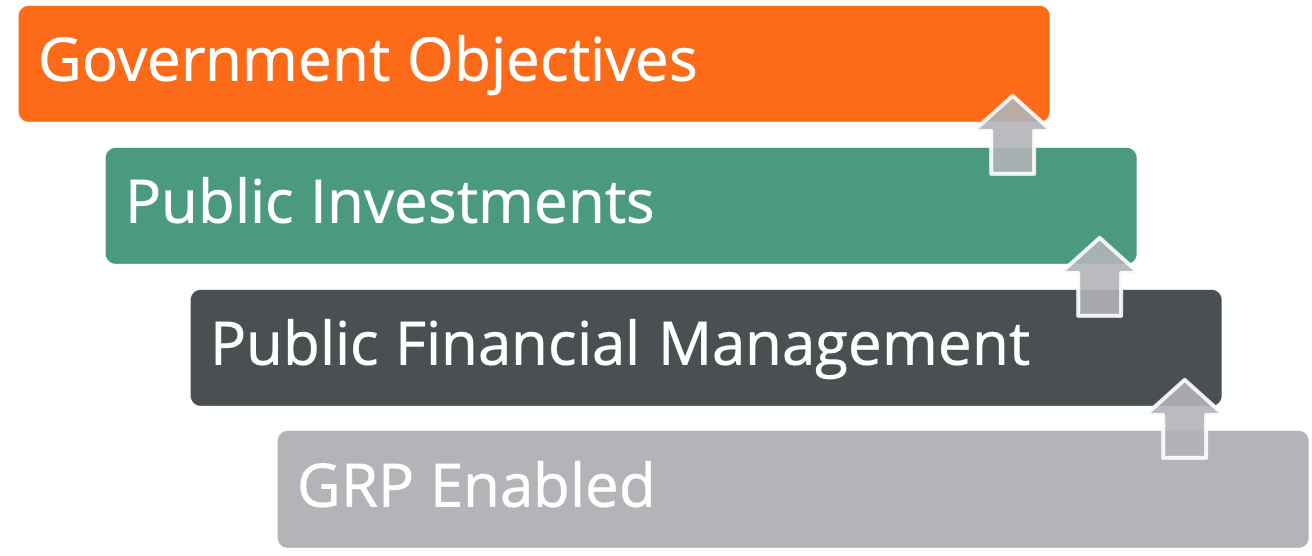

In other words, we discovered that our GRP contribution improved PFM that enable good public investments when integrated with government objectives.

Public Value and Government Performance

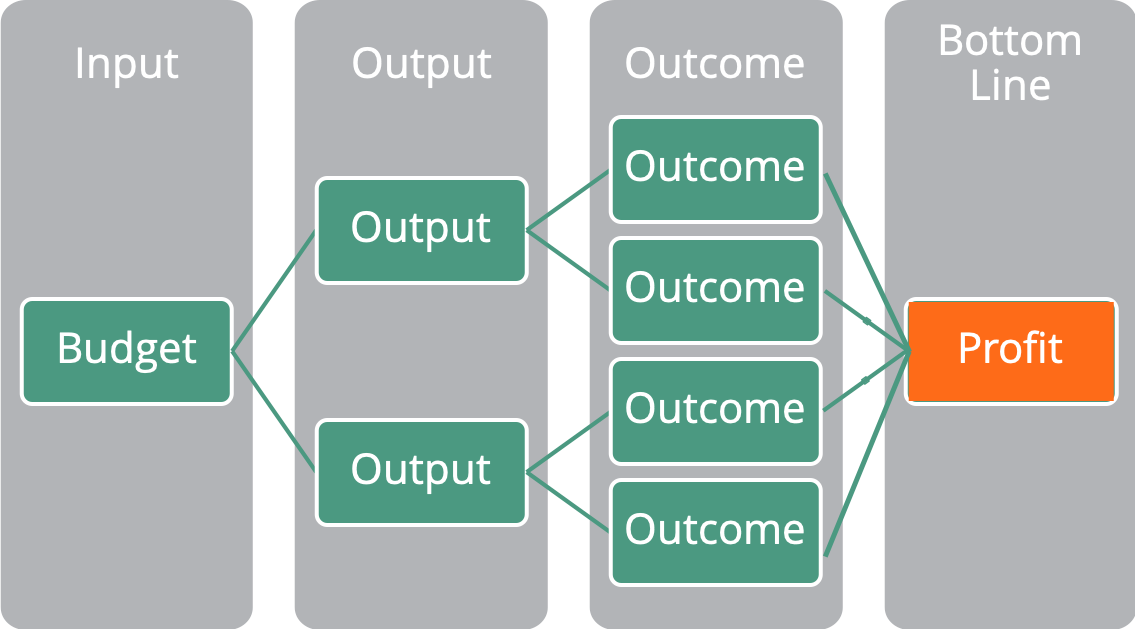

A key distinction is how success is measured. Businesses focus on financial returns and profit, while governments measure success in public value. This leads to the critical question of how to link public finances to public value and move from accounting to accountability.

Public financial management is fundamentally about public priorities and public investments that persist for years, such as building climate-resilient infrastructure and improving education. These priorities are often aligned with national development strategies and the Sustainable Development Goals (SDGs), with PFM contributing to SDG 16 (Peace, Justice and Strong Institutions) which supports social and public investments for the other 15 SDGs.

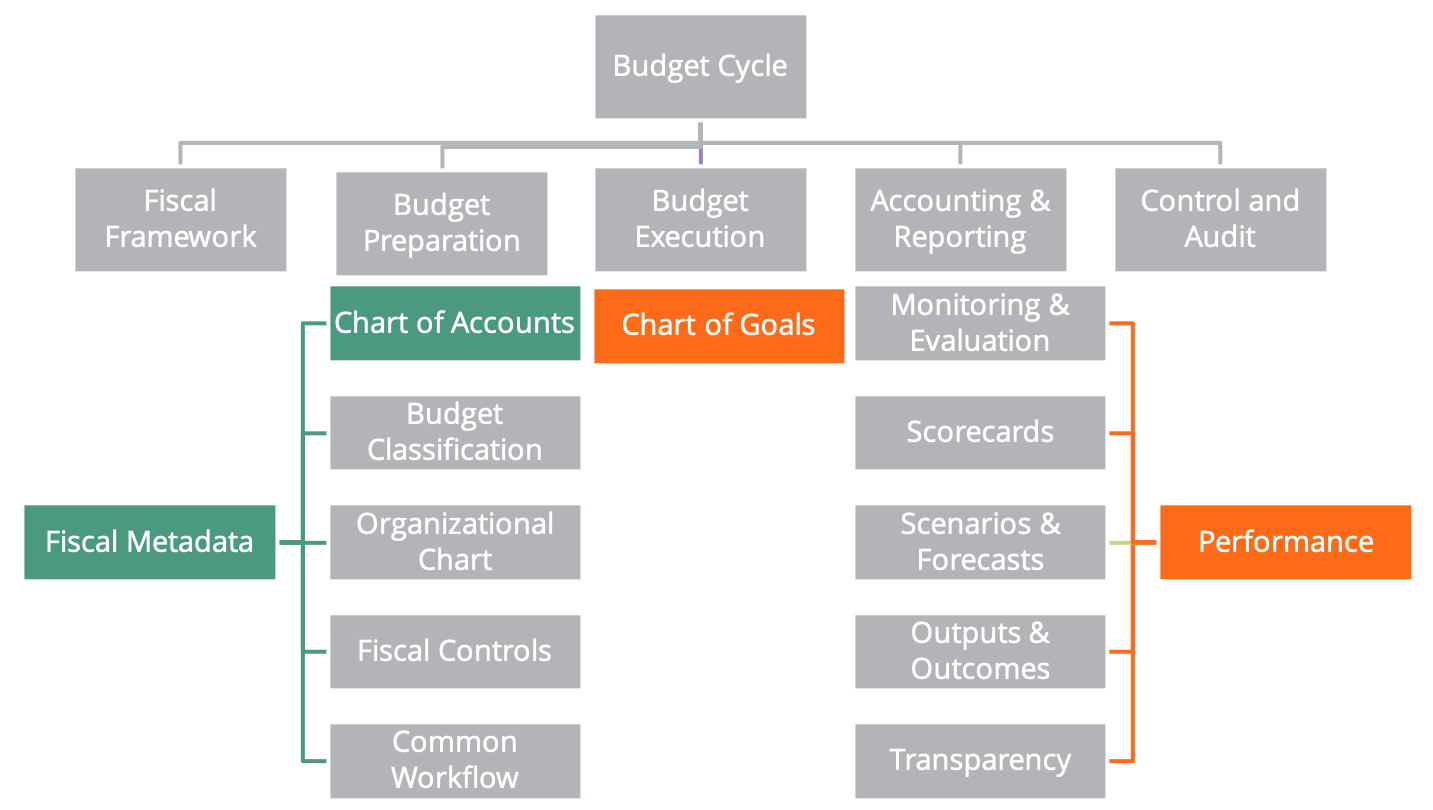

Effective PFM leads to outcomes like sustainable growth and citizen wellbeing. To achieve this, these outcomes need to be classified, monitored, evaluated, and improved. The Plano de contas is the key source of fiscal metadata that, when well-designed, aligns with government priorities and modernizes with reform over time. This is why the concept of a multiple-year Chart of Accounts is important.

We argued that performance management should not be considered separate from public finance. To truly modernize from accounting to accountability and strategy, these must be integrated. This is why the Gráfico de metas, which integrates with the Chart of Accounts, was developed. “Built for government” also means linking PFM priorities to national development strategies, vision documents, 5-year plans, and sectoral strategies.

FISC attendees asked about performance management in government. Performance management is far more difficult in government because of the lack of a bottom line, like profit/loss, in the private sector.

Governments focus on outcomes that are harder to measure, track and improve.

This led to a discussion about the fundamental performance concept in government – the equivalent to Return on Investment (ROI) in the private sector. Our conclusion: Relação custo-benefício (V4M). Governments leverage this concept for more than procurement: for all public and social investments aligned to national strategies.

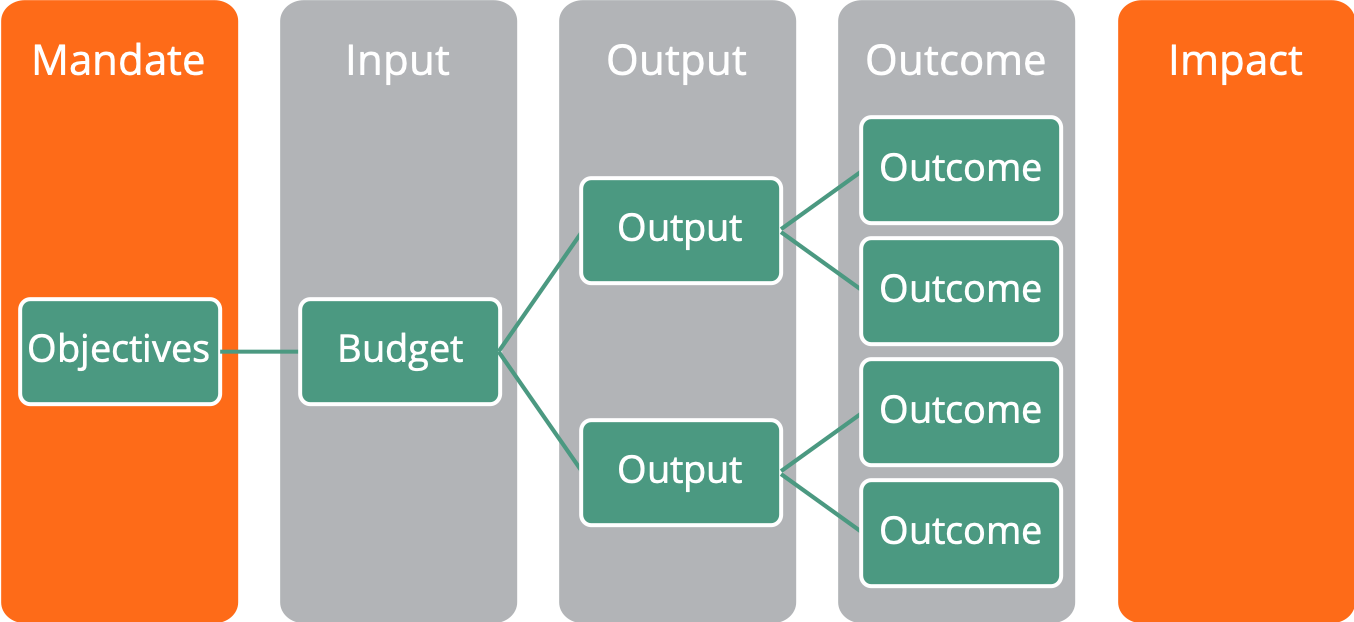

V4M measures the impact of government spending across the government performance cycle that consists of:

- Entradas: resources and budgets, such as health budgets, personnel, equipment, facilities and materials

- Processos: methods and processes used, such as how many inoculations are administered

- Saídas: count of services delivered, such as the number of inoculations provided

- Resultados: results of outputs, such as the incidence of disease after inoculations

- Impact: results of outcomes, such as the number of productive days worked attributed to inoculations

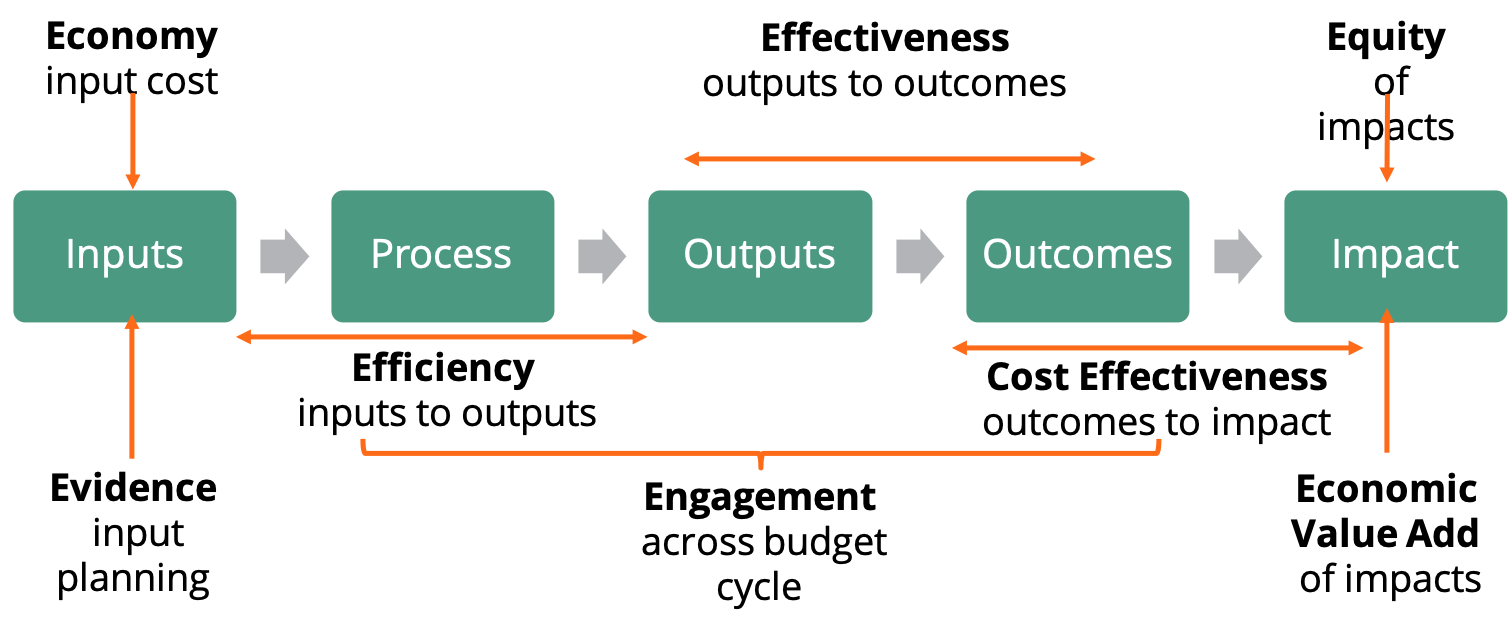

Numerous methods are used to track value including:

- Economia: cost comparison with similar items, often called “spend management” to identify less expensive alternatives and methods

- Evidências: quality of data and analysis used in budget planning

- Eficiência: productivity of turning costs into outputs, for example: the cost to deliver an inoculation

- Compromisso: extent to internal and external engagement to improve spending across the budget cycle, such as healthcare surveys about inoculation service delivery

- Eficácia: measures outcomes, such as the cost to reduce a disease by 1%

- Cost effectiveness: measures to delivery impact, such as the cost to increase 1 year of life expectancy

- Equidadeimpacto nos grupos, por exemplo, se esse aumento na expectativa de vida foi compartilhado por grupos desfavorecidos

- Economic Value Add: economic results of programs, such as increased number of productive days per inoculation

Performance Management Frameworks for Government

We integrate Charts of Accounts with Charts of Goals within the FreeBalance Accountability Suite™. This aligns output and outcome targets directly to budgeting and spending across budget cycles.

The Chart of Goals concept supports numerous performance frameworks. FISC attendees discussed the advantages and disadvantages of:

- Balanced Scorecard

- Key Performance Indicators (KPIs)

- Objetivos e resultados chave (OKRs)

Conclusões

We underscored that GRP is different from ERP and enables PFM, which in turn improves public spending and investments in pursuit of government objectives. The ultimate mission is “smart and balanced prosperity,” recognizing that national development strategies require governance mechanisms and digitization, making PFM digital a central theme. The key takeaway is the possibility of a world where every budget decision is directly tied to national priorities, and financial systems are about delivering measurable progress, moving “from accounting to accountability, from spending to strategy”. The journey to public finance outcomes continues, with tools and frameworks now available to make government performance measurable. The next step involves transforming insights into action, starting with the Chart of Goals.