Revenue management (or receipts management as it is often called) refers to the process of strategically optimizing revenue streams to maximize profits while minimizing costs. While this practice is commonly associated with the private sector, revenue management is becoming increasingly important in public sector organizations. With limited resources and growing demands for public services, it is essential for governments to effectively manage their revenue streams to ensure national financial sustainability and long-term economic success.

Why is Revenue Management Important in PFM?

Public Service Delivery

There are several reasons why revenue management is critical in Public Financial Management (PFM). Firstly, governments need to generate sufficient revenue to fund their operations and provide public services. This can be a challenging task, particularly when tax revenues are insufficient or unpredictable. Effective revenue management can help governments to identify new revenue sources, optimize existing revenue streams, and minimize wasteful spending.

PFM Resilience

In addition, revenue management can also help governments to improve their financial stability and PFM resilience. By reducing reliance on volatile or unpredictable revenue sources, governments can ensure that they have a stable source of income to fund public services, even during times of economic uncertainty or crisis. This can help to prevent budget shortfalls and minimize the need for austerity measures or borrowing.

Expenditure and Investment Management

Another important benefit of revenue management in government is the ability to prioritize public expenditure and investments. By analyzing revenue streams and identifying areas of high potential growth, governments can make informed decisions about where to allocate resources. This can help to ensure that public funds are used in the most effective and efficient manner, and that investments are targeted towards areas that will have the greatest impact on citizens.

The need for interoperability among all government financial systems critical to public expenditure and investment management. Having a single, unified Integrated Financial Management Information System (IFMIS) enables effective decision-making through a “single version of the truth” with consistent metadata across applications. It ensures commitment controls and segregation of duties are consistent among the various applications and it automates electronic transparency for budgets, procurement, tax administration, public investments, salaries, recruitment.

Transparency and Accountability

Finally, revenue management can also help to promote transparency and accountability in government. By making public finances available via a transparency portal, citizens can ensure that funds are being used in a responsible and ethical manner. This can help to build public trust and confidence in government, which is essential for promoting civic engagement and participation.

How to Improve Revenue Management in Government

So, what are some of the key strategies and practices involved in effective revenue management in government?

One approach is to diversify revenue streams and improve receipts management in State Owned Entities (SOEs). Governments can do this by identifying new sources of revenue, such as user fees or sales of surplus assets. For example, many governments are now exploring the potential of digital services and eCommerce to generate new revenue streams.

Another important strategy is to optimize pricing and taxation policies. Governments can do this by carefully analyzing economic activity and market trends, and adjusting pricing and taxation policies accordingly. This can help to maximize revenue while minimizing the impact on citizens.

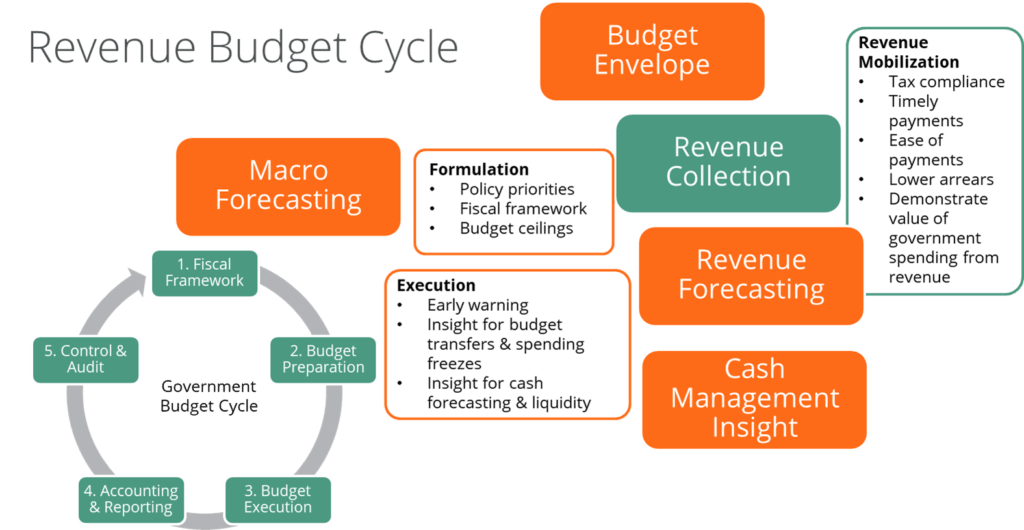

In addition, governments can also use data analytics and modeling tools to forecast revenue streams and identify areas of potential growth or risk. By using advanced analytics and predictive modeling techniques, governments can gain insights into revenue trends and patterns, and make informed decisions about resource allocation and investment.

Finally, effective revenue management in government also requires a strong culture of accountability and transparency. This can be achieved through robust financial reporting and auditing processes, as well as through open communication and engagement with citizens and stakeholders.

Conclusion

In conclusion, revenue management is an essential practice for governments looking to ensure financial sustainability and long-term success. By optimizing revenue streams, prioritizing spending and investments, and promoting transparency and accountability, governments can generate sufficient revenue to fund their operations and provide public services, while also building public trust and confidence. As governments face increasing pressure to do more with less, effective revenue management will become increasingly important in achieving their goals and serving the needs of citizens.

To speak to a Public Financial Management expert about how FreeBalance could help to improve revenue management in your country, please get in touch.