What is Government Treasury Management?

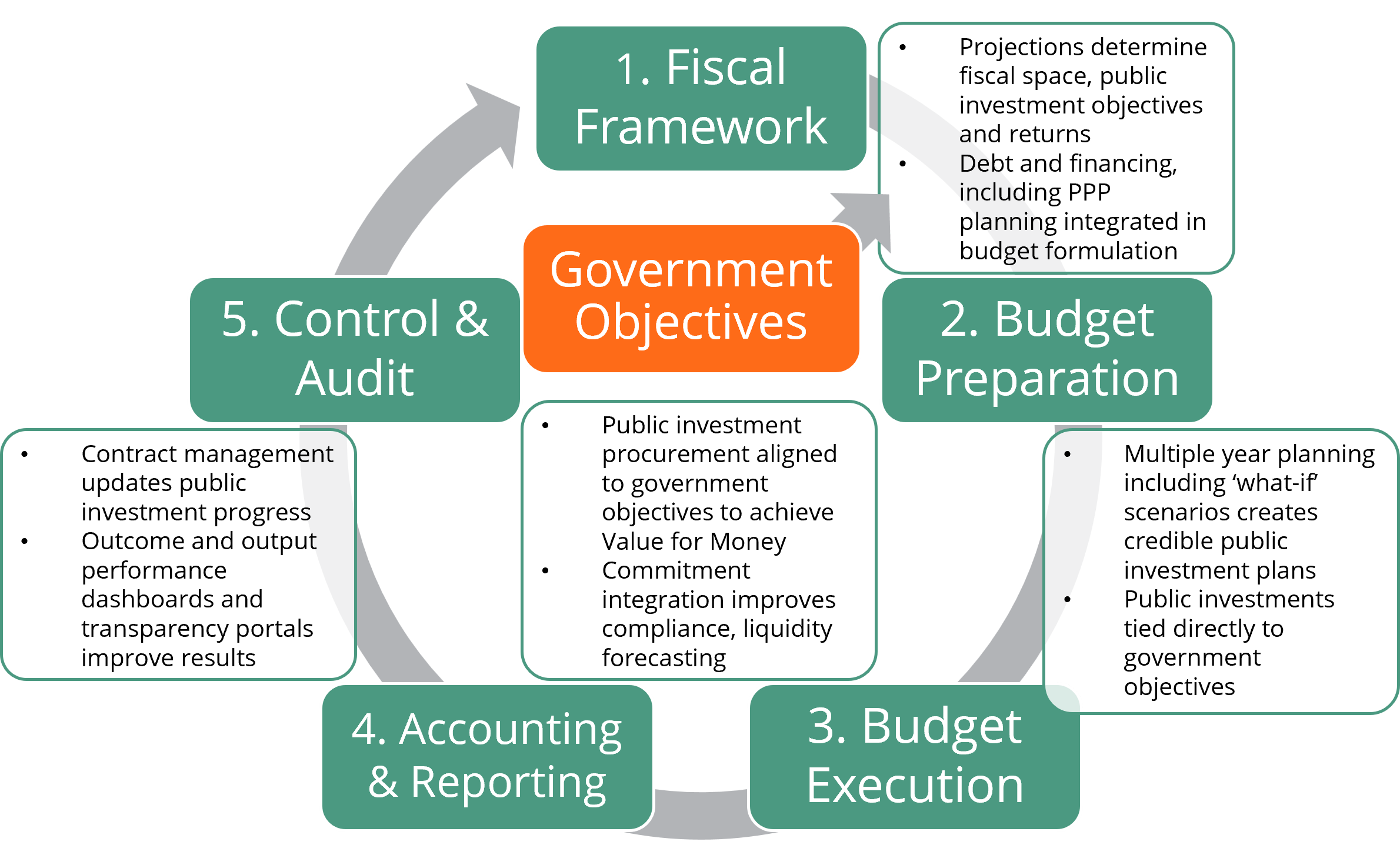

Treasury management refers to the process of managing an organization’s financial resources, including its cash, investments, and liabilities. Government Treasury Management is a critical aspect of fiscal governance that helps countries manage their financial resources, support economic growth, and ensure transparency and accountability in public finances. A well-managed treasury system can provide governments with the necessary resources to fund public services and investment in infrastructure, education, and health. This is where the FreeBalance Accountability Suite™ comes into play.

The FreeBalance Accountability Suite™ is an integrated and unified financial management information system designed to help governments manage their financial resources and improve governance, transparency and accountability. It is an enterprise-class Government Resource Planning (GRP) solution that provides a comprehensive suite of modules covering the whole of government. The (GTM) Government Treasury Management modules enable Ministries of Finance to manage their treasury operations, monitor their financial performance, and ensure compliance with financial regulations.

What are the Benefits of Treasury Management?

There are several benefits to effective Government Treasury Management. First and foremost, it helps to improve liquidity, ensuring that there is enough cash on hand to meet current and future obligations. This can help to prevent financial crises and allow the government to take advantage of investment opportunities as they arise.

Improved Cash Management

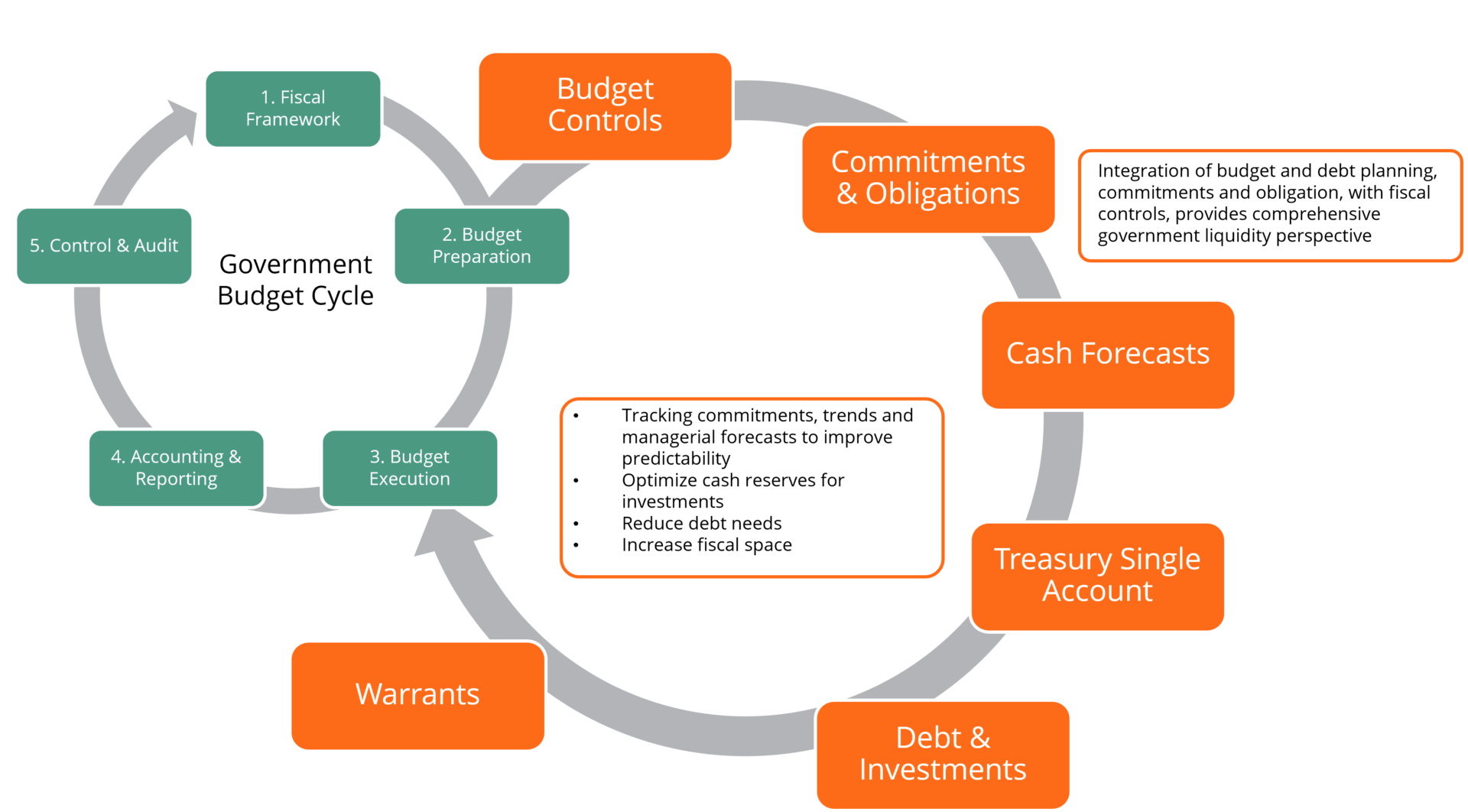

One of the key features of FreeBalance’s (GTM) Government Treasury Management solution is its cash management module. This module enables governments to manage their cash flow more effectively, providing real-time visibility into their financial position and allowing them to make informed decisions about their spending and investment priorities. The cash management module also helps governments to manage their banking relationships, streamline their payment processes, and reduce the risk of fraud and financial mismanagement.

Reduced Borrowing Costs

Effective treasury management also helps to reduce financial risk by ensuring that the government is properly hedging its investments and managing its debt. Accordingly, FreeBalance’s debt management module provides governments with the tools they need to manage their debt portfolio, monitor their debt levels, and ensure compliance with debt regulations. The debt management module also enables governments to plan and execute their borrowing strategies more effectively, helping them to secure the necessary funding for public services and investment.

Higher Investment Returns

The FreeBalance Accountability Suite™ also includes an investment management module, which enables governments to manage their investment portfolios more effectively. This module provides real-time visibility into the performance of government investments, enabling governments to make informed decisions about their investment strategies and optimize their investment returns. The investment management module also helps governments to manage their risks and comply with investment regulations, ensuring that their investments are managed in a responsible and transparent manner.

Improved Financial Transparency and Accountability

In addition to its cash, debt, and investment management modules, the FreeBalance Accountability Suite™ also provides a range of other tools and features that enable governments to manage their financial operations more effectively while improving transparency and accountability. These include budget management, accounting, procurement, and reporting modules, which help governments to plan and execute their budgets, manage their financial transactions, and report on their financial performance.

FreeBalance (GTM) Government Treasury Management System

One of the key advantages of the FreeBalance Accountability Suite™ is its flexibility and scalability. The solution can be customized to meet the specific needs of each government, and it can be scaled up or down as needed to accommodate changing requirements. This makes the solution an ideal choice for governments of all sizes and levels of complexity, from small municipalities to large national governments.

The FreeBalance Accountability Suite™ is also highly secure and reliable. The solution is built on a robust and secure technology platform, with advanced security features and controls that ensure the confidentiality, integrity, and availability of government financial data. The solution is also designed to be highly available, with built-in redundancy and failover capabilities that ensure continuous access to government financial data and applications.

Conclusion

Effective Government Treasury Management requires access to timely and accurate financial information, advanced analytics capabilities, and the ability to track financial transactions across multiple sources. These requirements are critical for governments that need to manage public funds effectively, ensure transparency, and comply with regulations. The FreeBalance Accountability Suite™ is designed to meet these needs, providing a comprehensive treasury management solution for governments of all sizes.

To find out more about FreeBalance’s (GTM) Government Treasury Management software, please get in touch.