Full automation of the budget cycle dramatically improves budget execution, enabling governments to deliver improved results.

Public Financial Management (PFM) is budget driven. The budget represents the legal embodiment of government intentions. Government organizations utilize software applications to manage the budget cycle. Over the last few years we have seen a trend towards unified and integrated PFM systems such as the FreeBalance Accountability Suite™. Today governments have to have the entire budget cycle covered by their Integrated Financial Management Information System (IFMIS) if they hope to meet their PFM objectives.

How FreeBalance’s GRP Supports the Budget Cycle

FreeBalance’s Government Resource Planning (GRP) system – the FreeBalance Accountability Suite™ – supports the entire budget cycle and enables more effective public financial management by:

- Linking budget and accounting processes to ensure that expenditures seamlessly match the budget law

- Identifying outcomes from previous fiscal years to improve results for the current year

- Integrating forecasts, trends and commitments to improve the use of cash and investments

- Determining key performance indicators to enable improved budget execution

What is a Budget Cycle?

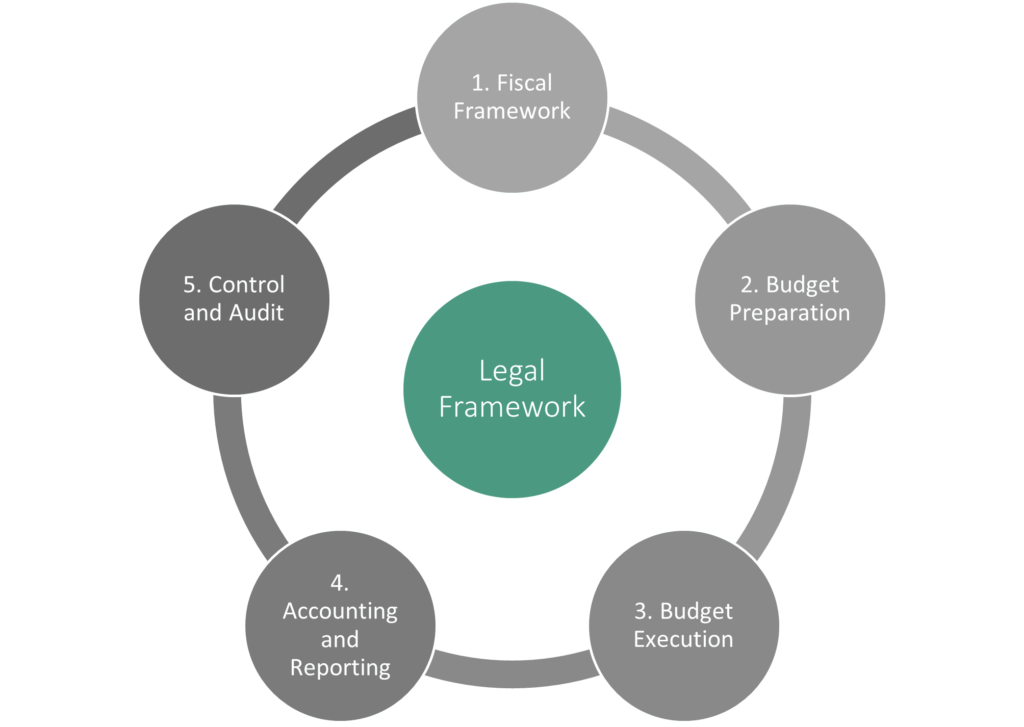

The budget cycle consists of three main stages:

- Budget Preparation or Formulation where government objectives are translated into budgets and appropriations. The budget preparation process includes comparisons with previous year budgets, actuals and outcomes. Multiple year budgets are typically prepared because many initiatives and programs require many years before results can be effectively measured. There is often multiple budget proposals prior to legislative approval and the creation of the Budget Law.

- Budget Execution represents public financial management functions that are budget-centric and are not accounted in traditional accounting. This includes up to two levels of commitments or encumbrances that sets aside funds from the budget. It also includes adjusting budgets to reflect macroeconomic changes, cash availability, forecasted budget variance and unexpected needs. Budget funds are transferred based on government legal requirements.

- Financial Management and Reporting represents the public financial management functions that are typically supported by traditional private sector accounting. Revenue and expenditures are accounted for in the appropriate ledgers. Revenue and Expenditures are accrued if the government is using a form of accrual accounting. Government cheques and electronic funds transfers are supported.

Important Budget Functions Often Missing from Government Systems

Some elements of the budget cycle are typically not automated or fully supported in ERP government systems. However, as FreeBalance’s GRP system is designed specifically for government, all of these elements are included in the FreeBalance Accountability Suite™.

Aid Management

Aid management is often not integrated within the budget preparation, execution or management systems. This means that for many governments that receive partner funds and intergovernmental transfers, these amounts are not accounted for in the IFMIS in any way. This restricts the government’s ability to effectively plan, especially if there is overlap in programs. It also prevents the government from effectively measuring the outcomes and contravenes the conditions attached to these funds.

Forecasting

Forecasting budget variances and running scenarios is often relegated to spreadsheet applications relying on data exporting. Expected budget variances should be presented to IFMIS users in real-time to enable improved decision-making. Scenario planning to determine the affect of currency exchanges, prices for common goods or changes to union collective agreements should be built into the system from budget preparation through execution.

Commitments and Obligations

Commitments and obligations are sometimes not supported in government systems. A commitment (or soft commitment or pre-encumbrance) is used to identify the beginning of an expenditure cycle such as when a purchase requisition is produced. An obligation (or hard commitment or encumbrance) is used to identify when the government has entered into a contractual agreement such as the issuing of a purchase order. Governments that track both steps can better forecast budget variances and cash requirements.

Cash and Debt Management Systems

Cash and debt management systems are often not integrated within the IFMIS. This prevents governments from using cash effectively to generate interest. It prevents governments from effectively tracking debt obligations and adjusting budgets.

Revenue and Expenditure Subsystems

Revenue and expenditure subsystems are often not integrated. Governments can be faced with lower revenue from taxation than planned. This requires budgetary adjustments to reflect budget deficit rules and cash requirements.

Extra Budgetary and Parastatal Revenue

Extra budgetary and parastatal revenue and expenditures are often not integrated with government financial information. The government may not have budget control over all entities or budget centres. Nevertheless, the government may benefit from revenue collected, is obligated to make up budget shortfalls or is subject for conditions from external partners.

Automating the Entire Budget Cycle Supports Decision Making

Government organizations are moving to the full support of the entire budget cycle. Full automation of the budget cycle provides necessary information to decision-makers. It enables comparing across multiple years and among governments and dramatically improves budget execution, enabling governments to deliver improved results.

To find out how FreeBalance could assist with the automation of the full budget cycle in your country, please get in touch.