From Fragile to Forward-Thinking

There is no public finance subject more important than resilience for the attendees representing Small Island Developing States (SIDS) at the 2025 FreeBalance International Steering Committee (FISC). These countries have unique vulnerabilities and disproportionate exposure to external shocks, especially climate change, natural disasters, economic volatility, and geopolitical dependencies, which means that public finance resilience takes top priority.

Yet all governments, regardless of size, geography, or income level, operate in an increasingly complex and volatile global environment. This means that building resilient public finance systems is essential to ensure governments can withstand, adapt to, and recover from shocks—both expected and unexpected.

At FISC 2025, we outlined a crucial journey for governments worldwide: the transition from reactive and vulnerable public financial management (PFM) to a state of proactive resilience. We discussed how forward-thinking governments transform PFM for crisis resilience while leveraging effective public investments for climate-smart sustainable development.

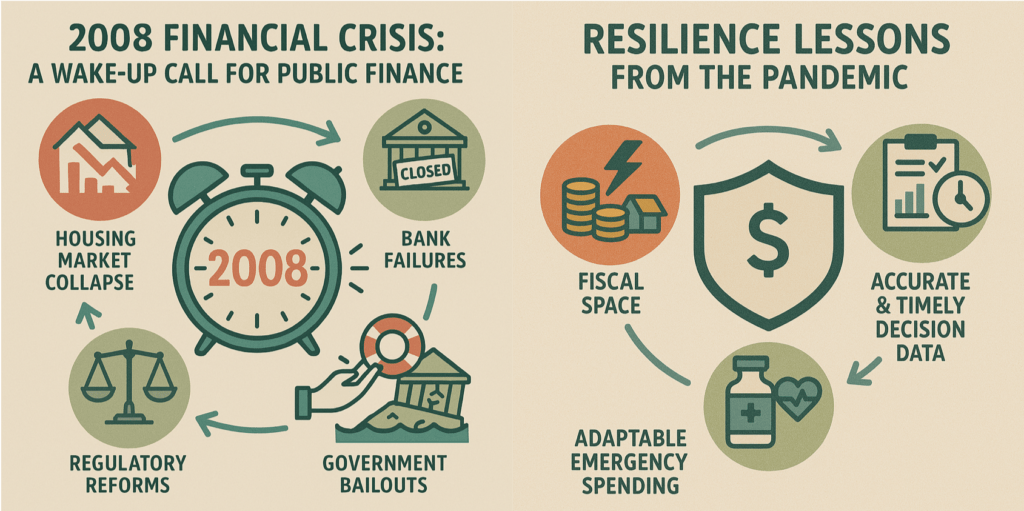

This smart journey begins by acknowledging lessons learned from past shocks. The global financial crisis highlighted the dangers of weak fiscal buffers, leading to difficult social programs and development spending choices. Crises exposed government fragility caused by a heavy reliance on external debt and the erosion of trust due to transparency deficits. Yet, many Emerging Market and Developing Economy (EMDE) governments, including FreeBalance customers, demonstrated good resilience practices. Some of these governments demonstrated better resilience than advanced economies. The lesson? Focus on fiscal space and contingency planning for unexpected global financial shocks.

Building on financial crisis lessons, we addressed the increasing impact of climate events. These events have often overwhelmed existing contingency plans and fiscal space, particularly in SIDS. The unpredictable nature of events like earthquakes and hurricanes contrasts with the well-known risks of climate vulnerability. We highlighted:

- ineffective decision-making through lack of integration among financial systems

- delayed disaster response funding through rigid financial systems

- increased corruption and waste perception through the lack of tracking and transparency.

Some countries have shown resilience by leveraging climate insurance and fiscal rules that anticipate known risks. Governments do not know when natural disasters will exactly occur, only probabilities. As one FISC attendee noted from his experience in a SIDS: “we have it all: cyclones, tsunamis, earthquakes, and volcanic eruptions.” But we can proactively ‘expect the unexpected’, and utilize adaptive, forward-looking fiscal frameworks, combined with flexible Government Resource Planning (GRP), to boost resilience.

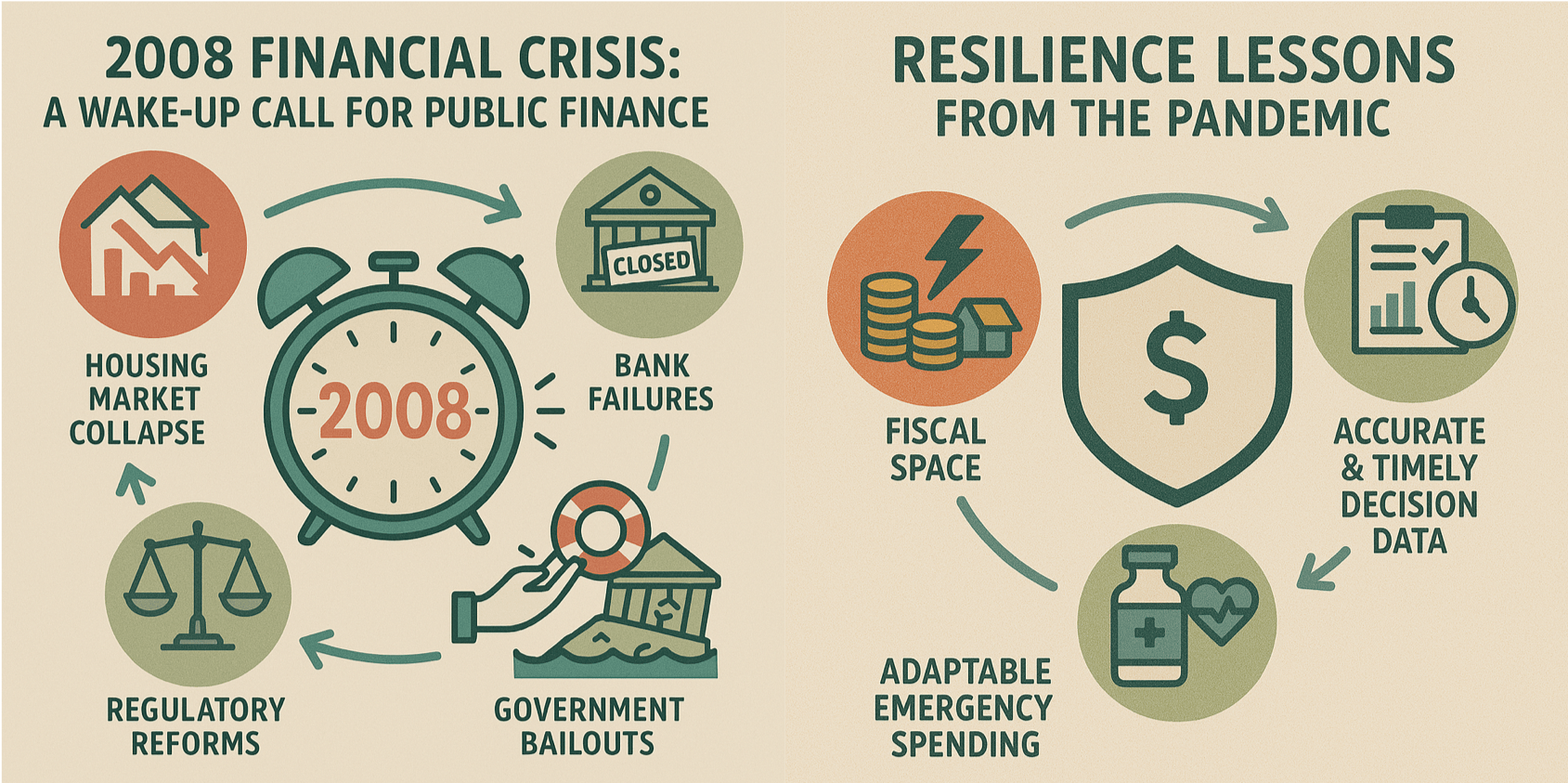

We discussed the impact of revenue shocks, which disproportionately affect countries with weaker resilience, further reducing fiscal space. Emergency spending revealed gaps in procurement controls and cash management. A lack of cross-ministry coordination (people) and integrated systems (technology) resulted in delayed and poor-quality information for decision-makers, impacting service delivery for affected citizens.

Conversely, we recognized that some nations were able to combat these challenges, leveraging robust information systems for decision-making, spending, and transparency, and positively reinforcing through real-world experience that resilience requires interoperability among financial systems and subsystems.

From sharing these experiences we can recognize that governments should leverage lessons from financial shocks to build PFM resilience. In other words, aim to expect the unexpected.

Three Pillars of PFM Resilience

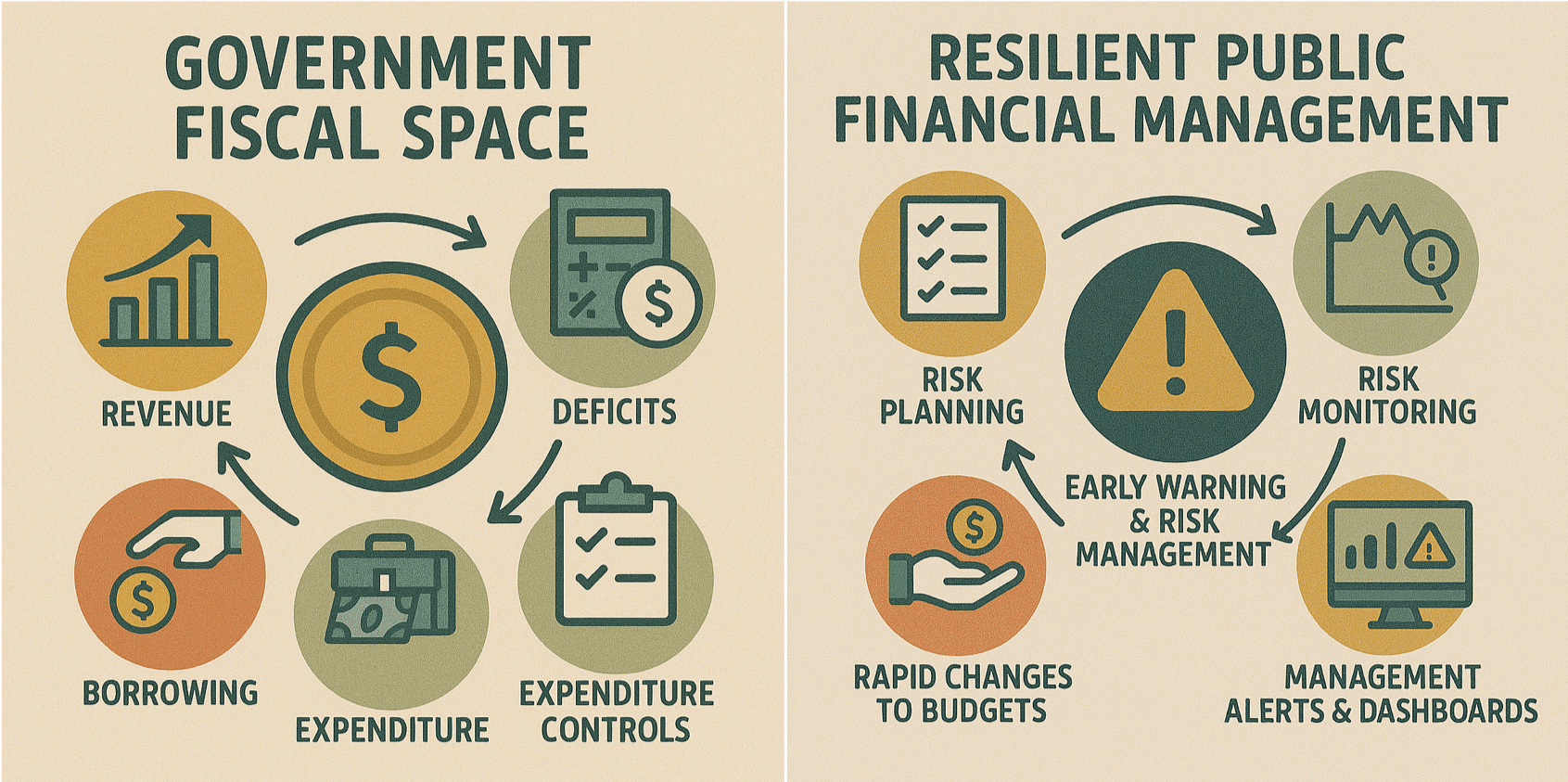

The core of building financial strength rests on three pillars: prediction, preparation, and protection.

Pillar 1: Predict

Effective risk planning and early warning systems further enhance resilience. This involves integrating risk management into budget cycles. Decision-support lessons include developing public finance dashboards for real-time fiscal stress signals through integrated systems. Institutionalizing scenario planning for multiple crisis triggersen supporting agile budget control changes accelerates effective crisis responses.

Pillar 2: Prepare

Governments with fiscale ruimte, characterized by lower deficits and the ability to borrow, are more resilient to fiscal shocks. Actions taken by these governments include prioritizing medium-term fiscal frameworks with contingency funds and clear buffers en strengthening domestic resource mobilization through tax reform and expenditure compliance technology. Debt sustainability analysis and prudent borrowing are also crucial to withstand external shocks.

Pillar 3: Protect

Successful implementation of pillars 1 and 2 should enable governments to maintain essential services in a crisis, and to scale up support, targeting assistance to those citizens most in need. Transparency is crucial in this stage, as without effective visibility of how funds are spent, there is the opportunity for corrupt practices (at the cost of citizen support).

Resilience Foresight in Public Finance

Pillar 4?

If we were to add a fourth pillar to this established set of three, it would be “praoctive”. Governments ready to respond to fiscal shocks are also more resilient because they proactively leverage the Government Resource Planning (GRP) features at their disposal to:

- enable adjustments and workflow improvement

- strengthen reporting and transparency (especially debt transparency) to build market and public trust

- integrate systems for rapid reallocation and disaster response financing

- monitor fiscal information for early warnings.

In essence, predict, prepare, protect is public finance proactively perfected.

Proactive Climate Resilience

At FISC 2025 we also emphasized the importance of integrating climate financing to move from survival to resilience leadership. Climate shocks significantly impact growth, revenue, and public spending. Resilient governments:

- integrate climate vulnerability assessments into fiscal frameworks

- plan mitigation measures

- expand resilience to climate adaptation by assessing costs and benefits

- build resilient infrastructure through public investments

- track climate public investment infrastructure trends

- align national plans with climate finance eligibility criteria

- strengthen project preparation capacity for climate funding pipelines

- de-risk public investments through various mechanisms like regulatory changes, public-private partnerships, development partner funding, climate insurance, and green/blue bonds.

These actions are fully supported by the government’s public finance systems, which can be used to:

- channel and report climate finance transparently

- adopt green budgeting frameworks

- position public finance institutions as leaders in climate-smart governance and prudent fiscal management

- demonstrate success in climate PEFA and climate PIMA to access funding.

Conclusie

Our overarching message was that resilient public finances turn shocks into stepping stones for growth. As one FISC attendee and FreeBalance customer noted, “we want to turn the negative experience of a crisis into a positive opportunity for the future.” Governments should leverage crisis experiences to improve resilience, leveraging public finance resilience for climate financing, and demonstrate sustainable growth through resilient infrastructure. We concluded the session by suggesting a roadmap for governments to modernize from fragile to resilient, highlighting how the FreeBalance Accountability Suite™, combined with our functional resources, can enhance interoperability and reconfigure systems for resilience.

For a fuller understanding of how the FreeBalance Accountability Suite™ can support public finance resilience, contact met ons opnemen.