Moving from Integration to Interoperability

Why Interoperability is Important in Public Financial Management

Public Financial Management (PFM) experts coined the term “IFMIS” (Integrated Financial Management Information System) to refer to government systems that integrated core financial functions. However, very few government FMIS are truly integrated.

Integration is in a horrible state in many countries with multiple silos, legacy systems, and manual processes. Causes include:

- Multiple custom subsystems with different technologies and classifications

- The combination of custom and Commercial Off-The-Shelf (COTS)

- The difficulty of integrating modules from a single ERP system (despite the marketing noise from these vendors)

We all seemed to have given up on the “integrated” aspiration for Government Resource Planning (GRP) and then along came the pandemic. Suddenly governments were reallocating spending, procuring PPE supplies and medical equipment, assisting businesses and citizens, supporting public servants to deliver citizen services remotely and still (mostly) tracking spending.

Interoperability is now more important than ever. However, ‘integration’ as originally conceived with ‘IFMIS’ is not enough.

- Integration at the database level is a poor IT practice because there is no metadata and interfaces will break

- Integration at key points in the budget cycle, usually with vouchers, is superficial and prone to error

- Integration without metadata management generates many versions of the truth, compromises decision-making and audit

- Integration through APIs and web services lacks resilience to software changes, especially when these integration methods are not commercially supported

- Integration without shared budget, commitment, and approval controls introduces compliance risks

What is Interoperability?

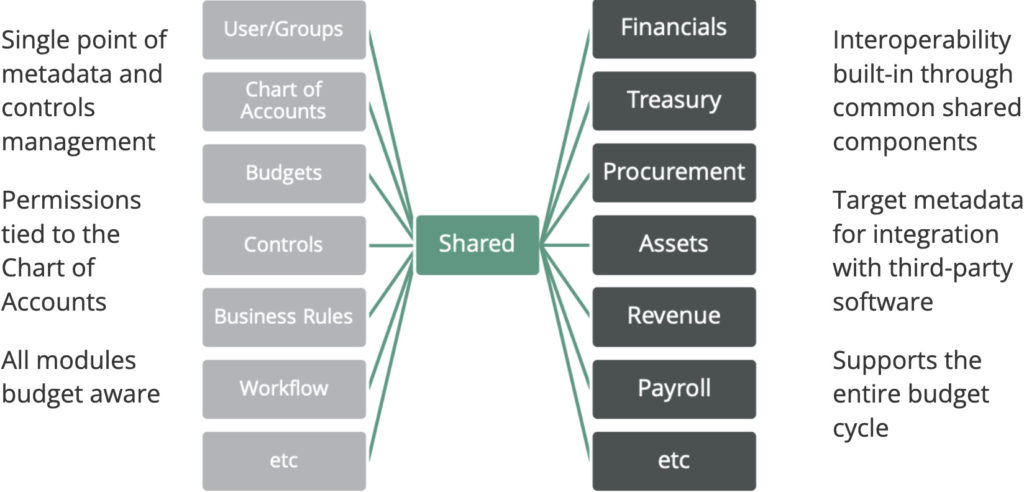

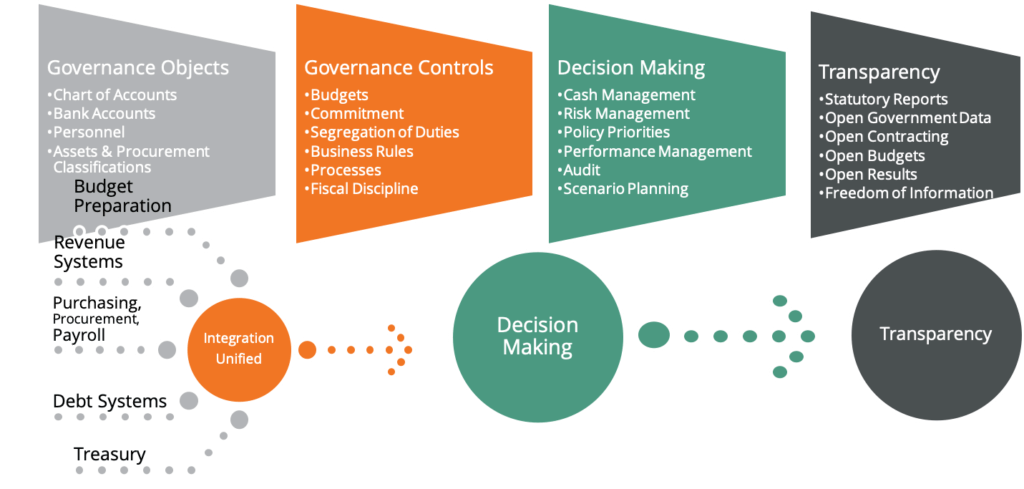

Interoperability between a government’s various systems and the FMIS means that integration is automated, with no need for any manual interface processes. The potential for corrupt practices is therefore reduced. Through the integration of metadata, such as the Chart of Accounts, organizational charts, budgets, programs and vendors are shared among financial applications which in turn share controls such as commitment controls and the segregation of duties.

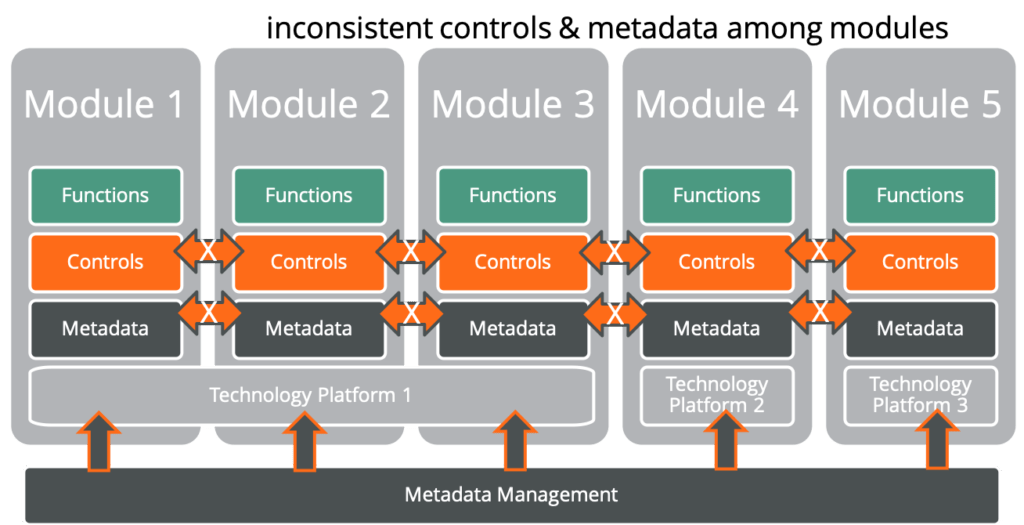

Traditional Monolithic Approach

In legacy systems, large monolithic components are assembled as module silos (including modules acquired as part of a merger) with proprietary integration and some support for open standards, but it requires metadata management to interoperate.

Legacy Approach of FMIS Integration

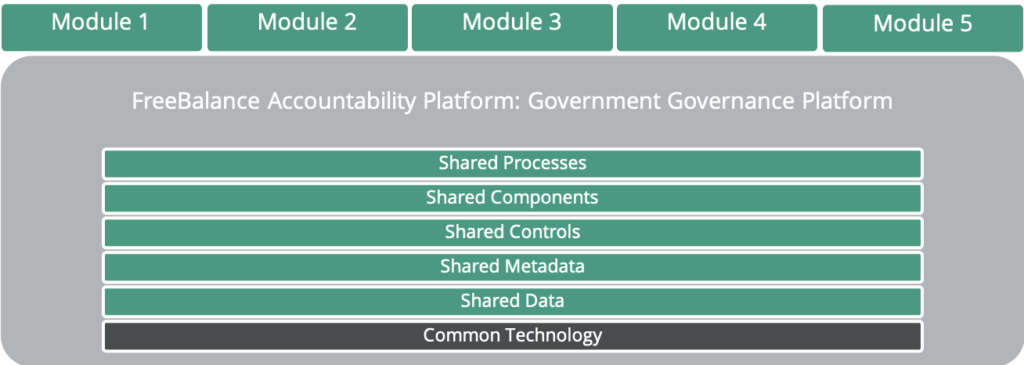

Interoperability Offers Seamless and Unified Integration

The FreeBalance Accountability Suite™ provides seamless integration across all government information systems unified through the FreeBalance Accountability Platform™.

- All core (and some non-core) are built on the same functions

- A single environment where all modules share the same metadata and controls

- Change the Chart of Accounts, change a process, transfer an employee, depreciate an asset: once

- No need for a metadata management system or integration callisthenics

Postmodern Interoperability

Interoperable Government

In postmodern systems such as FreeBalance’s GRP, granular components are shared across the suite that inherently interoperates with a single point of metadata management.

Integration has also proven to be elusive in governments who think simple bespoke systems will cost less and have similar benefits to COTS. Many governments using custom-developed systems cannot provide timely information to decision-makers and the amount of overnight batch processing for consolidated reporting or transparency portals in some countries is astounding.

Public Financial Management Implications

Consider the following scenario (that happens far too often)…

- A government ministry attempts to procure something when the procurement system is not interoperable with core financials

- The ministry can procure based on different classifications than described in the core financial system

- The ministry can skip over the segregation of duties in the procurement

- The ministry can record the procurement as anything in the financial system COA

- And, it can show up in government accounts as an emergency expenditure when it isn’t

This would not be possible when using a system with unified integration.

The FreeBalance Approach

The Ideal Government IFMIS: Interoperable Financial Management Information System

The entire FreeBalance portfolio is built on the FreeBalance Accountability Platform™, a web-based, Java-powered platform designed exclusively for government financial management. The platform supports centralized, decentralized or hybrid deployment models and includes several unique benefits.

- Postmodern Design

- Postmodern Design through ease of integration, massive configurability and flexible on-premises, private cloud, public cloud, community cloud and shared services support

- Web Native

- Web Native using international web standards, no legacy software code deployed via the web and no web translation layer

- Open System

- Open System supporting robust open source and commercial infrastructure through recognized industry standards, providing more choices

- Unified Design

- Unified Design through component reuse across all applications, centralized metadata management, with ease of reporting

- Highly Extensible

- Highly Extensible supporting additional functions and custom development thanks to a Service Oriented Architecture (SOA) and component reuse across applications

- Progressive Activation

- Progressive Activation enables future configuration changes, process modernization, fiscal decentralization, and adding additional modules