Effective management of public expenditure is considered an essential part of good governance. But what exactly is public expenditure management, and what role does it play in sound public sector fiscal practice?

In this article, we will delve into the role and principles of effective public expenditure management, explore its benefits, discuss essential tools, and highlight the role of technological solutions in improving operational efficiency.

What is Public Expenditure Management?

Public expenditure management is a discipline within public financial management and refers to the process of managing all functions related to government spending and public expenditure control. It is a critical function of government that helps ensure fiscal responsibility and accountability.

It has three main objectives:

- managing government spending, which includes planning and working within budgets, and ensuring spending is properly approved and procurement processes followed

- ensuring resources are appropriately managed, for example making sure investment is aligned with government policy

- improving efficiency in operations, including reducing manual operations and protecting against corruption.

To deliver on these principles of public expenditure management, finance professionals must oversee budget formulation and execution, necessary accounting, and comprehensive reporting.

Why is Public Expenditure Management Important?

The case for public expenditure management reform is compelling.

By effectively managing government spending, governments can more effectively:

- control inflation

- reduce the level of debt

- improve the allocation of resources.

Public expenditure management helps to ensure that public funds are spent efficiently and effectively, supporting the delivery of important public services. It is therefore a key element of good governance. Government spending, and how it is managed, impacts economic growth, is essential for achieving macroeconomic stability and can help to control inflation and reduce deficits.

Managing public expenditure also serves as a linchpin in fostering transparency and accountability within government finances. By providing sight of government spending, ideally in a way that the general public can understand, citizens can more easily appreciate economic factors and their impact on society. They can support or challenge spending decisions in a more informed way, and governments can demonstrate progress against their manifesto commitments.

Effective public expenditure management systems allow governments to create this desired transparency. But they are also fundamental in improving efficiency in fiscal operations. On an operational level, public expenditure management systems make it easier for government officials to allocate resources efficiently, prioritize public needs, and monitor expenditure against predetermined goals.

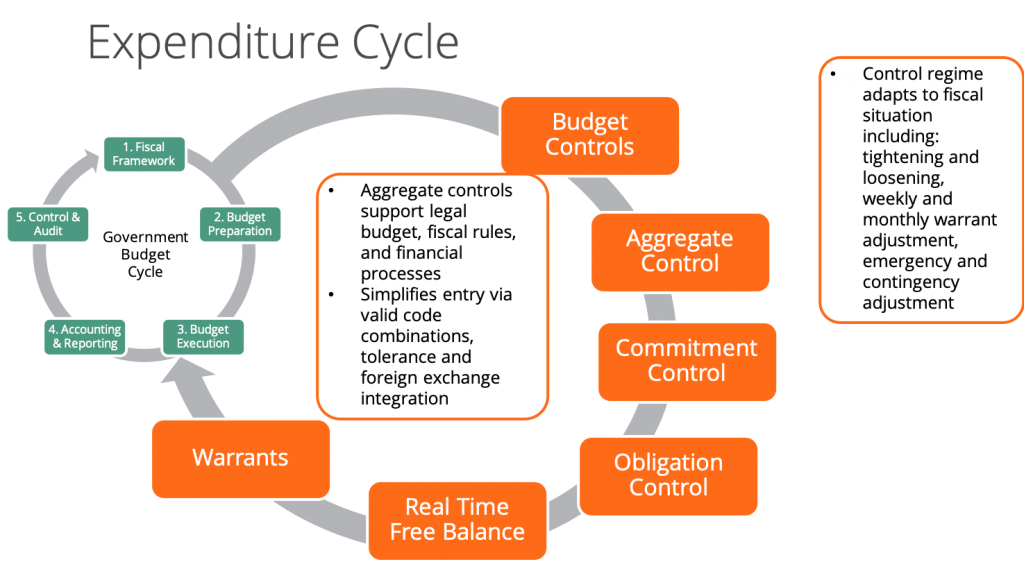

Governments have unique needs when it comes to managing expenditure, including budget and commitment controls. This exceeds typical accounts payable functionality common in the private sector. This is why enterprise resource planning (ERP) systems designed for businesses often fail in government.

Public Expenditure Management Tools and What They Do

Effective public expenditure management has moved on from paper-based processes to technical solutions which facilitate transparent fiscal operations. These should address the specific needs of governments, and include:

- Budgeting modules which enable the formulation and monitoring of complex budgets, ensuring alignment with government objectives

- Accounting systems, which provide accurate recording and tracking of financial transactions

- Procurement modules, which enable transparency in procurement processes and minimize corruption risks

- Payroll modules, which automate salary calculations and disbursements, and provide assurance that employees are paid the correct amount and on time.

These tools, when integrated into a comprehensive financial management platform, enhance the efficiency and effectiveness of public expenditure management and help governments meet their financial goals.

It is important to note that governments have unique needs, including budget and commitment controls, which exceed typical accounts payable functionality common in the private sector. This means that many enterprise resource planning (ERP) systems designed for businesses often fail in government. Picking a government-specific tool helps to mitigate this risk.

Case studies from various regions highlight successful implementations that have resulted in significant resource savings, improved service delivery, and strengthened financial governance.

How Can FreeBalance’s Public Expenditure Management Software Improve and Promote Operational Efficiency?

FreeBalance brings together 40 years of experience in public financial management in the FreeBalance Accountability SuiteTM, a web-based tool designed specifically for managing government finances.

(PEM) Public Expenditure Management is one of the six core product pillars within the FreeBalance Accountability Suite™ . Using these tools enables governments to:

- track spending against budgeted amounts and provide real-time data on expenditures

- provide in-depth analysis of financial data for government performance management

- streamline procurement processes, from requisition to purchase order to invoice processing

- ensure compliance with procurement policies and regulations

- track the progress of projects, monitor costs, and manage project budgets and resources

- manage vendor information, including authorizations, certifications, and ratings

- automate manual processes reduces the risk of errors

- free up civil servants’ time to focus on more value-added activities.

The (PEM) Public Expenditure Management product is composed of a number of modules that can be implemented as a standalone or part of a unified solution. The modules reflect all functions related to government spending and include:

- (PECM) Contract Management

- (PECT) Catalogue Management

- (PEEP) e-Procurement Portal

- (PEGP) Electronic Government Procurement

- (PEPR) Purchasing & Expenditure

- (PEEM) Government Expenditure Management

- (PEPU) Government Purchasing Management

- (PESM) Spend Management

- (PERF) Government Expenditure Revolving Funds

FreeBalance’s (PEM) Public Expenditure Management software is not a one-size-fits-all system. It is highly configurable and requires little to no software development to meet specific government needs, meaning it can be easily and quickly adapted to your organization’s requirements.

For more information on how the FreeBalance Accountability Suite™ can support your government’s expenditure management, speak to one of our PFM experts.