Budget planning is the cornerstone of effective governance, involving the strategic allocation of limited resources to diverse policy priorities. But it is a complex landscape to navigate, and senior officials around the world grapple with challenges such as limited resources, competing policy priorities and economic uncertainty.

In emerging or fragile countries, this can be compounded by a range of additional factors. These include establishing a robust financial infrastructure, managing rapid economic changes, fostering sustainable growth while addressing disparities, and managing the effects of conflict.

Regardless of country context, successful service delivery, financial stability and citizen well being depend on effective budget management.

Building a Budget in Government

The foundation of effective budget planning begins with in-depth analysis of economic indicators. These statistical metrics help to evaluate various aspects of an economy’s performance, providing insights into the overall health, trends, and stability of an economy. Common economic indicators include:

- Gross Domestic Product (GDP)

- Unemployment rate

- Inflation rate

- Interest rates

- Consumer Confidence Index

- Government debt

- Trade balance.

Economic indicators play a crucial role in budget planning for several reasons:

- They help to estimate the potential revenue that the government can generate. For instance, a growing economy may lead to increased tax revenues.

- They allow policymakers to anticipate the demand for government services. During economic downturns, there might be an increased need for social welfare programs, for example.

- They help government officials make more informed decisions about fiscal policy, taxation, and public spending. Specific action may be required to stimulate economic growth or address economic challenges.

- They help to identify risks by acting as early warning signs. Economic analysis may forecast a future recession, and, knowing this, officials can take pre-emptive measures to mitigate negative impacts on the budget.

- They support prioritization of policies and projects. For example, during times of economic growth, governments might allocate resources to infrastructure development.

However, economic indicators are only part of the picture: governments also need to balance diverse stakeholder interests.

Diverse perspectives bring a wealth of insights and ideas to the table, enriching the decision-making process. Incorporating various viewpoints ensures a more comprehensive understanding of the potential impacts of budgetary decisions.

Different stakeholders often have divergent priorities and preferences. For instance, while business groups may advocate for tax cuts, social welfare organizations may emphasize increased spending on public services. And diverse stakeholder groups may have unique insights into the needs of specific communities or sectors.

This can be further complicated by political motivations, as government officials may face pressure to prioritize the interests of specific influential stakeholders. This can create disparities and undermine the equitable distribution of resources.

Actively engaging with diverse stakeholders throughout the budget planning process and using data to prioritize investment objectively can mitigate any negative impact of diverse stakeholder opinions. Clearly communicating how decisions are made, and the factors considered, can reduce suspicions and foster collaboration: transparent and inclusive decision-making processes help build trust.

The Emotional Resonance of Budget Planning

Budgeting can seem a dry, or purely data-driven, process. But the decisions made around budgets and investments can have an emotive impact, particularly when it comes to the effect on citizens’ day-to-day lives.

For example, senior officials grapple with challenges in balancing immediate needs with long-term sustainability goals and navigating political pressures for immediate spending. Responding to pressure today to implement an initiative can risk long-term fiscal health. Establishing a clear vision for long-term fiscal sustainability and transparent decision-making processes enables officials to demonstrate the balance between needs today and tomorrow.

A well-structured budget plan acts also as a strategic tool to allocate funds swiftly and effectively when facing unforeseen circumstances. Unfortunately natural disasters, pandemics and unexpected conflicts mean that those responsible for budget planning need to balance the need for emergency funds with other budgetary priorities. Establishing efficient mechanisms for swift fund allocation is also critical as insufficient emergency funds and/or inefficient allocation mechanisms can impact citizen health or safety.

The Budget Planning Process as a Strategic Journey

The budget cycle encompasses four phases: preparation, approval, execution and oversight.

Budget Preparation

Also known as budget formulation, this is where government strategy is turned into specific budget allocations. A fiscal framework driven by the government strategy is turned in a one-year or multiple-year plan (called a Medium-Term Budget Framework).

Formulating a budget involves looking back at previous year’s investments and the results of these investments: did the program deliver the expected results? Is further investment needed? Should a new program build on previous work?

As noted above, developing economic and fiscal policy involves balancing ambitious policy goals with realistic resource availability, and this can be complicated by competing and/or interlinking priorities across different government entities (for example healthcare and housing).

Budget Approval

It can take several iterations of a budget plan before the budget is formally approved by a country’s legislature. If it takes a long time for a budget to be approved, service delivery can be impacted. This translates into pressure to quickly set a viable and appropriate budget.

The budget may be approved at one point in the year, but it is never “finished”, as public officials need to make adjustments based on macroeconomic changes, cash flow and unexpected needs. Implementing robust revenue collection mechanisms and utilizing financial management tools for real-time monitoring and control help to safeguard against risks.

Budget Execution

Budget execution is a critical phase within the government budgeting framework. It refers to the implementation of the approved budget, where financial resources are allocated, disbursed, and used to achieve the objectives outlined in the budget plan.

While many large organizations have similar budgeting processes, government finance leaders are impacted by the scale of operations, the interlinked nature of gathering revenue and investing public funds wisely, and ongoing citizen and media attention.

Budget Oversight

As noted, there are many eyes on government spending, and ensuring appropriate oversight of public funds ensures that the investments made and revenue generated match the budget plans.

To do this, governments need to ensure robust financial reporting, monitoring and performance evaluation. This can be challenging because of the sheer amount of information involved, and the fact there are multiple departments and agencies to manage. And, as with all areas of public financial management, there is a balance to be struck, so that information is shared for data-driven decision making, without the burden of unnecessary administrative load.

Utilizing Technology in the Budget Planning Process

Government organizations can benefit from using specially designed technology platforms to manage the budget cycle. The Freebalance Accountability Suite™ helps to address the challenges at each stage of the budget process, through access to data, process automation and easy-to-use performance management tools.

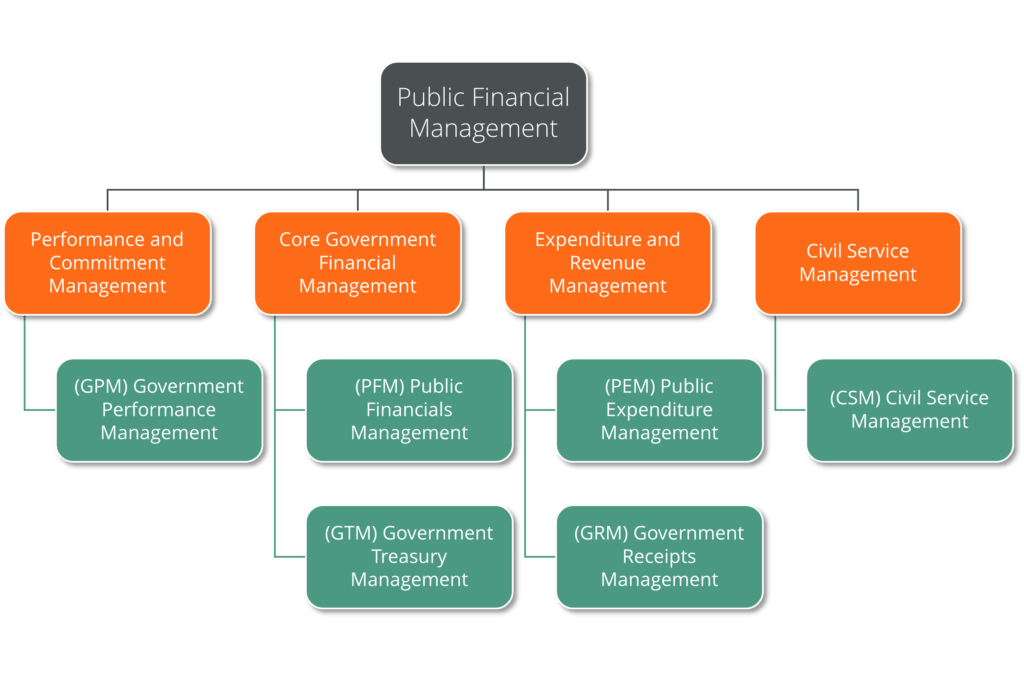

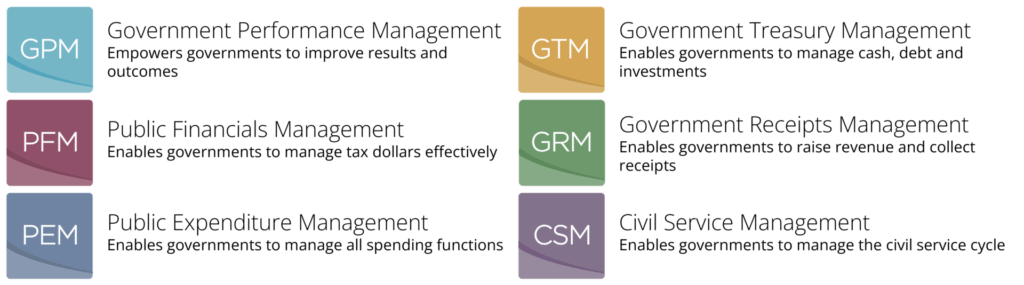

The FreeBalance Accountability Suite™ acts as a comprehensive Government Resource Planning (GRP) solution, covering the entire budget cycle and managing critical fiscal systems. It is composed of six pillars which align to the budget planning journey:

You can read more about how each FreeBalance product supports a stage in the budget planning process in What is the FreeBalance Component Map?

Challenges in government budget planning, such as limited visibility into financial data, historical data utilization, integration of forecasts and commitments, and determining key performance indicators are all addressed by the FreeBalance Accountability Suite™.

FreeBalance has successfully implemented its GRP solution in over 25 countries, managing over $400 billion budget dollars. The FreeBalance Accountability Suite™ has been instrumental in achieving predictability, control over budget execution, sound public finances, and greater fiscal stability through improved transparency and accountability.

The purpose of a budget in government extends beyond mere financial planning. It is a comprehensive tool that guides policy, promotes fiscal responsibility, fosters transparency, and contributes to the overall well-being and stability of a nation. As a result, government leaders need a solution which recognizes the unique challenges and requirements of public financial management. With the FreeBalance Accountability Suite™, senior public officials can more easily manage key processes, and promote transparency, leading to increased citizen trust.

Read more about FreeBalance’s budget planning tools.