What is a Chart of Accounts?

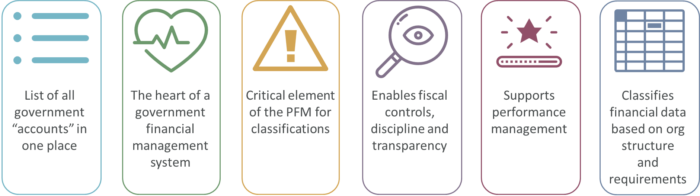

The Chart of Accounts (COA) or “budget classification” is arguably the most critical part of effective Public Financial Management (PFM) reform and Integrated Financial Management Information Systems (IFMIS) design. The COA for government is more complicated than in the private sector and the COA often changes to reflect legal and financial management reform.

The COA contains the meta data for the government. It encapsulates the organizational structure including regions, source of funds, programs and objectives and accounting concepts like capital and recurrent budgets. It is used to create and control budgets. To support international public sector accounting standards. To provide management information and to aid in decision-making.

Why is the Chart of Accounts Critical for Effective Public Financial Management?

But, it’s not about a COA “best practice.” It’s about a COA good practice – where the budget classification is structured to what is most important in a country and to the capacity of the public service. That’s why the COA needs to be multi-year: to easily enable changes over time to reflect reform in organization, capacity and objectives. This is a requirement in all countries and we have seen numerous material changes to the COA from Canada to Timor-Leste.

Governments should have the ability to compare across structures and years. They need to be able to look at last year’s information by different COA structures.

What Challenges do Governments Experience with Charts of Accounts?

Government organizations are challenged to adapt COAs to support modernization such as the introduction of performance budgeting, accrual accounting or new national reporting. Changes within the organizational structure of government are also commonplace requiring changes to the classification structure.

Many governments find that underlying custom-developed systems and ERP software make changes to COAs difficult.

Frequent changes to COAs across fiscal years makes reporting and comparison difficult. Budget preparation and analysis requires the ability to compare information across fiscal years even though that information is classified differently.

What are the Good Practices in Chart of Accounts Design?

- Integration of budget and accounting classifications: in countries where the budget classifications are not integrated with the COA, or only partially integrated, there is risk of loss of important information undermining the effectiveness of budget control and reporting.

- Sufficient structure for fiscal management: the COA should include fund source, organization, economic and function classifications.

- Adaptability: The COA should be able to be changed – particularly in the context of an Integrated Financial Management Information System (IFMIS) – to respond to changes such as reorganization of government and changing needs.

- Simplified structure: to facilitate data entry, the structure of the COA should be intuitive and usually no more than 30 digits in total and support easy ways to find the right classifications.

- Reporting Objects: The COA can drive external reporting and transparency (such as FreeBalance’s Transparency Portals) without adding any burden to data entry through the use of alternative roll-up structures or “side concepts”.

- Integration with authorization: permissions and access within the Government Resource Planning (GRP) system (such as the FreeBalance Accountability Suite™) should be directly linked to the COA to control access.

- Error checking and validation: across COA segments so that it is impossible to associate an expense against programs or economic purposes that are not owned by a line ministry and to validate debits and credits

What is a Multiple Year Chart of Accounts?

According to the International Monetary Fund, the COA should allow flexibility for future additions and changes as far as possible. A multiple year COA enables governments to map across classifications through many years.

Benefits of a Multiple Year Chart of Accounts

- Reporting on any fiscal year based on the COA of any year in the system

- Matching aggregate budgets and programs across multiple years

- Supporting accrual accounting reporting on previous non-accrual years

- Calculating the reality of cost savings initiatives like departmental consolidation or shared services

- Supporting multiple year commitments and obligations even though classifications have changed

- Providing full budget histories across multiple years to assist in developing more credible budgets

- Identifying cost efficiency opportunities through multiple year comparisons

How Does the FreeBalance Accountability Suite™ Support Multiple Year Charts of Accounts?

FreeBalance’s Government Resource Planning (GRP) software, the FreeBalance Accountability Suite™, allows for full configuration of the COA.

- COA design requires flexibility to change structure such as add segments, change organization alignment and re-classify some or all of the metadata

- COA design must have ability to map classifications from year to year

- Data integrity must be supported to eliminate any “orphan” COA elements

- Specialized reporting objects that are not visible for data entry are enabled. This is used to roll up detailed information from the COA in different methods to support changing reporting requirements

- Adding a new line item within the existing COA structure during the fiscal year should require little effort

- COA design should support valid code combinations and standard offset accounts to reduce data entry errors

- Desirable that the tool for COA design is graphical, supports XML import and provides for draft classifications for review

Given the importance of the Chart of Accounts, The FreeBalance Academy offers a self-paced, online course on how to design and leverage the COA.

To speak to a Public Financial Management expert on how FreeBalance could help to improve your Chart of Accounts, please get in touch.