The future of IFMIS, or Government Resource Planning (GRP), was addressed at the Inter-American Development Bank workshop, The Cutting Edge on Information Technology on Public Financial Management in December. Presenters, like myself, were given 7 questions to answer. There wasn’t much time to get into details, so here’s an expanded answer. Although the workshop was focused on Latin America and the Caribbean, there are lessons for governments worldwide to consider. We all need to be concerned about the lack of GRP progress in the region.

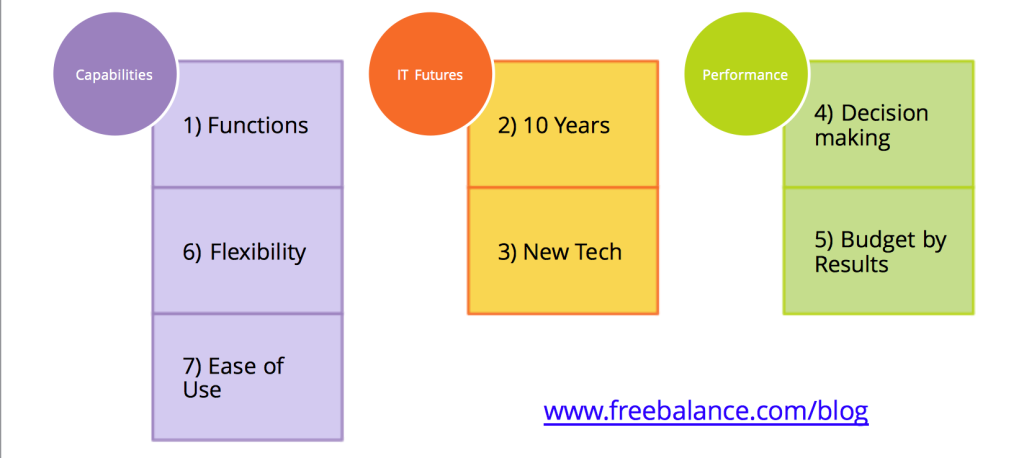

The questions covered GRP capabilities, IT futures and government performance.

New and Future IFMIS Capabilities

Which are the new functional and technological options available to explore and what impact developers could expect in terms of developing integrated IFMIS supported by different information systems/platforms that should be able to cope with specific demands of each core process (budget, accounting, treasury and debt management) while sharing a common financial information structure?

- Unified: Move from so-called “integrated” suites where functions like budget, accounting, and treasury can operate with inconsistent metatdata to unified designs where functions, controls and metadata are supported across all applications. This means that commercial functionality in applications like the can be reused across all applications, including those custom developed on object-oriented platforms. (This is the approach taken with the FreeBalance Accountability Platform.) Governments who require custom developed systems will find that hybrid approaches of using commercial government-specific platforms will overcome cost, delay and agility problems experienced when only using technical platforms.

- Budget-aware: Integration of budget controls across all financial subsystems. The traditional silo approach of acquiring separate payroll, procurement, asset and debt systems has resulted in government arrears and lack of compliance with controls. Governments often exceed budgets when controls are not integrated and applications are not budget aware.

- Different platforms: The use of different technical platforms and programming languages has led to siloed implementations of financial subsystems in Latin America. These systems often have different metadata are do not enable easy integration. Many of these platforms use legacy technology. So, there is no elegant way to use these different platforms to achieve a unified design. Metadata management tools will require core code to change in custom-developed financial systems and subsystems. A risk approach is needed to determine which applications ought to be replaced, which can be retrofitted and which can operate stand-alone. A platform approach is required to make this determination.

How to increase flexibility of the IFMIS and accelerate the development/incorporation of new technologies considering the investment already done?

- Zero-based budgeting: The cost to support legacy technology can exceed replacement. So, the “investment already done” may be the incorrect way to look at flexibility. The key management exercise is to compare the costs to achieve Public Financial Management reform and modernization with current systems versus more modern systems.

- Flexibility and progressive activation: There is no lack of flexibility in custom-developed financial systems or ERP. The problem is “ease of change”. Code customization, rather than configuration, is the culprit. Flexibility to adapt functions requires a configuration approach.

- New technologies support: There is great promise to new technologies like cloud computing, smart government, big data and mobility to improve government efficiency and effectiveness. And, there are new technologies around the corner. The technology choices of the past dictate flexbility of the present and future. Therefore, it is critical that governments adopt open technologies that respect open standards, rather than proprietary software.

How to be more user-friendly and facilitate access to financial operations (both on revenue collection and payments by the government) without losing reliability and security?

- Non-functional considerations: There ought not to be any relationship between improved ease of use and reduced reliability and security. Many IFMIS implementation projects focus on compliance with functional requirements rather than non-functional like compatibility, reliability, security, usability maintainability, and portability. It’s often in these non-functional areas where governments experience problems. Therefore, it is important that these areas become better defined.

- Ease of use: There is no mystery to improving ease of use in financial applications. The main problem in change management is that many users see new systems in the light of older systems. This often means making systems harder to use by following convoluted processes of the past. The use of design-thinking with prototypes and agile development can overcome this “catch 22.”

IT Futures and GRP

During the next ten years what will be the most important impacts of information technology on the development of IFMIS considering its cost of development or acquisition, and maintenance?

- Platform approaches: The use of object-oriented platforms, metadata standards, service buses and functionality re-use will make GRP systems more financially sustainable and reduce TCO. The investment is the acquisition or development of functionality will be reused across multiple modules. This will reduce the costs for additional functions. The use of platforms will increase maintainability where single changes can be reflected across multiple applications.

- Government apps: The move from big systems to an orchestration of smaller systems, using platform approaches, will enable governments to create simple user-friendly web and mobile applications. These applications for internal and citizen use will improve government effectiveness and leverage information trapped in back-office GRP systems.

- Internet of Things: IoT, combined with big data analytics, will provide more effective instrumentation of government processes.

Explore the use of new technologies as blockchain, cloud ERP and on-demand systems.

- Open systems: Governments will find the adoption of new technologies very difficult with antiquated, proprietary and silo financial systems. For example, it is difficult to take advantage of distributed ledger systems, like blockchain, when you have many silo ledgers that all operate differently, and with different definitions.

- Cloud ERP: The concept of “cloud ERP” can be misleading. First, ERP tends to imply software originally designed for the private sector that is difficult to adapt for government. Second, “cloud” can be deployed in many ways. Third, non-ERP Enterprise Software like HR and CRM tend to be growing faster. There’s a lot of misinformation about cloud these days, with many vendors “cloud washing” by making outrageous claims. The key lesson is that governments should be able to deploy applications in data centres (i.e. as government “shared services), or in the public cloud. And, governments should be able to move applications between public and private cloud.

- Smart Government: My view is that there is a major shift away from systems of record like traditional IFMIS to systems of engagement. This fundamentally changes the nature of governance. Engagement technology like open government and smart government requires efforts a digital transformation. The technology has great promise, but only with organizational and societal change management.

- Blockchain: Blockchain has rapidly become the technology that solves all problems. At least, that’s the hype. Blockchain provides trust in non-trusted environments. We see blockchain as a critical anti-corruption mechanism for revenue and expenditures.

Government Performance Management

How to increase the use of IFMIS in the decision-making process in the countries and improve the quality of public expenditures?

- Failure to meet design needs: The core deliverable for GRP is to improve resource allocation and improve decisions. That’s the baseline. Failure of existing systems to plan, control and manage public expenditures means that there needs to be a rethink. There’s something wrong with systems that fail to meet the baseline. Governments need to identify sub-standard systems and replace them. Consider the situation where governments run into arrears and require supplemental budgets. The cost of poor controls and decision information far exceeds software replacement.

- From functional to performance structures: GRP systems are often designed using functional structures of government. This has been the traditional method of financial controls used in manual systems. The difficulty with management based on organizational (Ministries, Departments, Agencies) input (budget) structures is that there is no way to measure the quality of public expenditures. Efficiency and effectiveness is measured on outputs and outcomes. Therefore, classification structures need to modernize to support performance indicators that are directly tied to government objectives. This means cascading performance indicators to detailed organizational objectives using program budgeting. The balanced scorecard could be the ideal mechanism to develop these structures.

- Reporting vs. analytics: Governments require the production of statutory reports. There is much focus on report compliance. This does not necessarily improve public expenditures. More flexible methods of tracking performance, such as the use of dashboards, is required to improve decision-making. The lack of integration among financial systems reduces the timeliness of decisio information. Very little information is needed in “real time”, but it needs to be timely.

How to increase the definition and use of performance data in the IFMIS considering the framework of Budget by Results initiatives and evaluations of results of public programs?

- Budget by results: Multiple-year planning with explicit goals is required to support budget by results. In addition to the performance observations from the previous answer, GRP systems need tightly integrated budget planning and budget execution. Simple stand-alone budget preparation systems that provide organizational budget requests are ineffective. Budget preparation systems need to model scenarios across multiple years.

- Spending reviews: Governments often conduct deep spending reviews. These reviews are used to determine whether spending goals are being met and whether different methods of allocation could be more effectives. The use of performance classifications facilitates the process. Spending reviews can result in significant allocation changes. Effective budget classification structures that can adapt over time, the “multiple year chart of accounts” is an important non-functional design criteria for GRP systems.