Governments are at the nexus of overcoming the effects of polycrises and PFM provides the toolkit

The World Economic Forum, in partnership with Marsh McLennan and Zurich Insurance Group recently published the 2023 Global Risk Report. Let’s not forget that the WEF warned us of pandemic risks…in 2006! And, that many countries are experiencing the negative impact of many identified risks.

What do risk management methodologies tell us?

- Risk Avoidance: governments cannot avoid risks with high negative impact, and high probability

- Risk Mitigation: governments need to budget to mitigate risks, and track public investment performance

- Risk Monitoring: governments need to identify emerging risks quickly

- Risk Acceptance: governments can consider accepting low impact and low probability risks, based on risk appetites

The Permacrisis or Polycrises Era

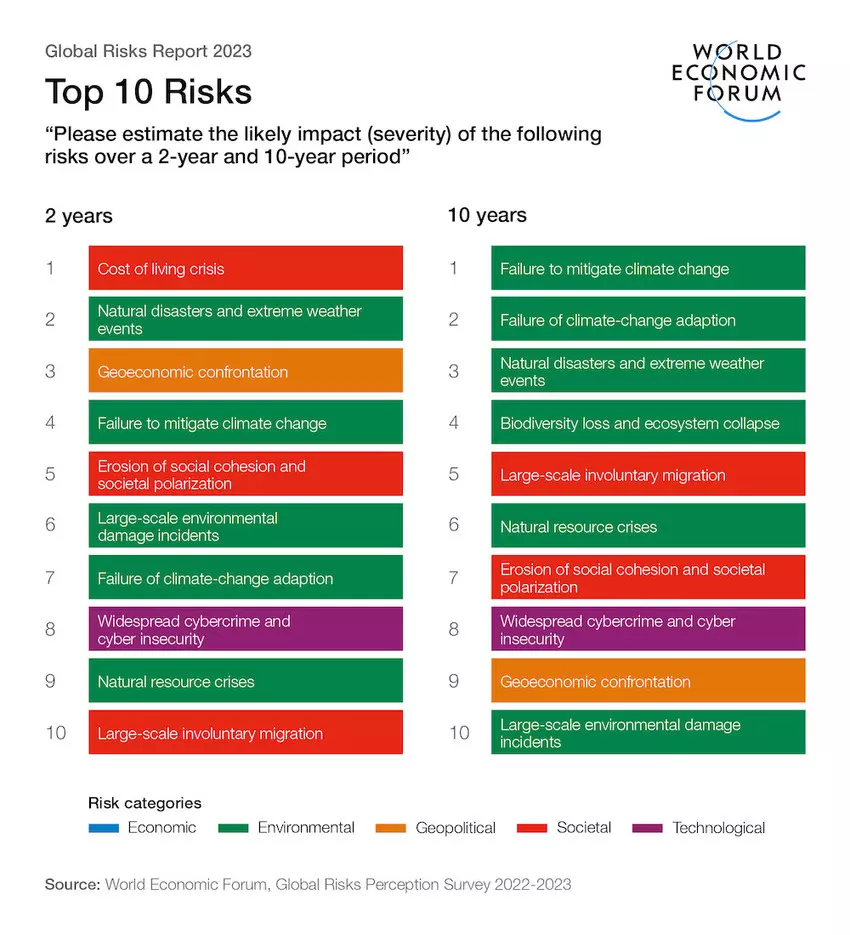

The Collins Dictionary 2002 word of the year was permacrisis. Economic, environmental, geopolitical, societal, and technological risks identified by the 2023 Global Risk Report contribute to this “extended period of instability and insecurity”.

How Can Governments Manage a Permacrisis?

What can finance ministries accomplish if the world is at “a critical inflection point”? An IMF working paper by Richard Allen, Yasemin Hurcan, Peter Murphy, Maximilien Queyranne, and Sami Yläoutinen described finance ministry “policy functions such as setting fiscal policy rules or targets, managing fiscal risks, developing a debt strategy, formulating the annual budget and the medium-term budget framework, and providing advice on alternative tax policy options. Such functions are at the core of a finance ministry’s work, and occupy a substantial part of the time of its senior officials and ministers.1”

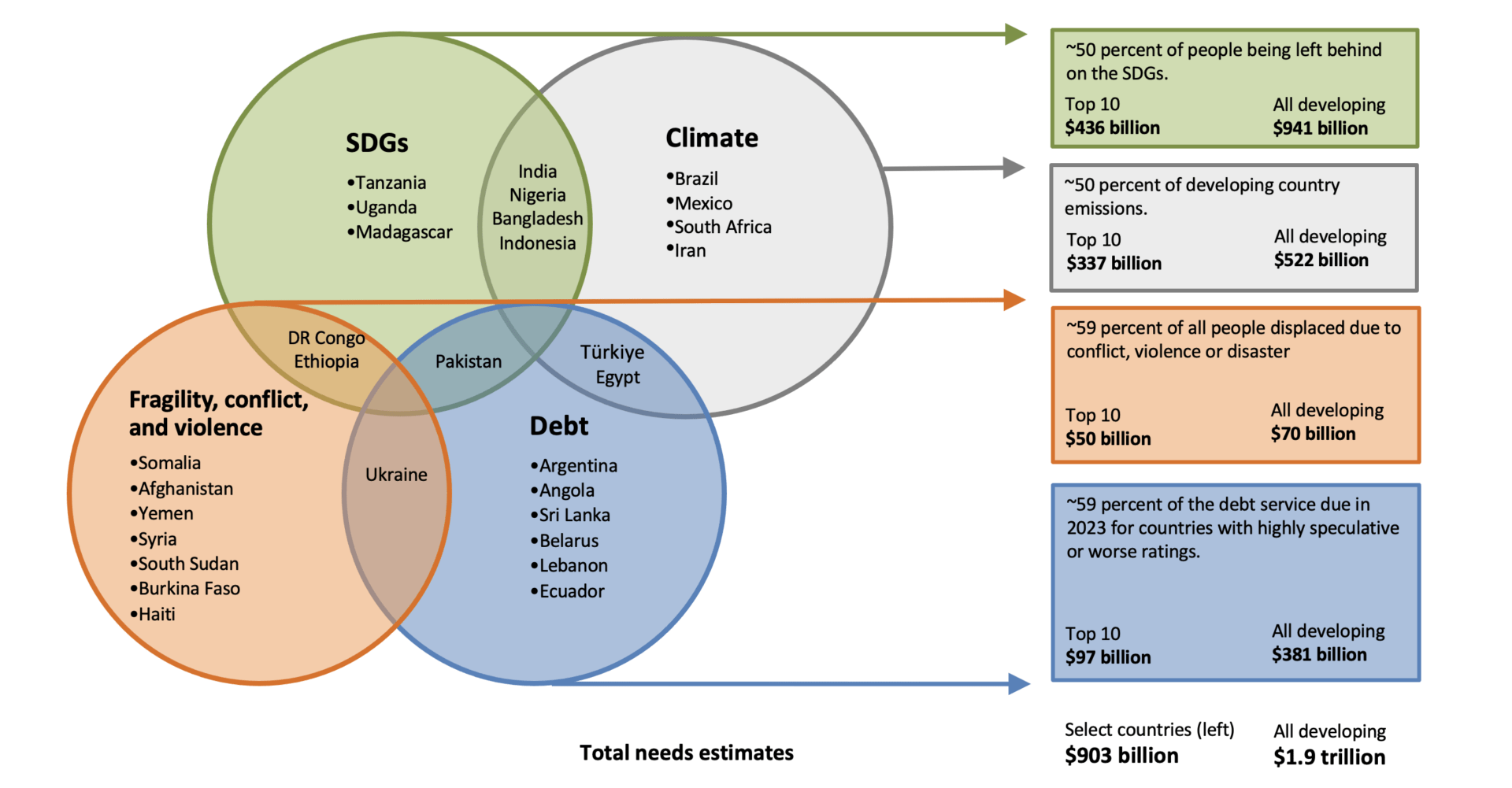

In other words, many finance ministries are process oriented. This needs to change if those countries are to survive and thrive in a polycrisis era. As Homi Karas and Charlotte Rivard of the Brookings Institution point out: ”At the country level, there need to be better policies, stronger institutions, and sound economic governance.” Their analysis suggests “four priority areas in economic development where there are major gaps: (1) SDGs, (2) climate, (3) debt vulnerability, and (4) fragility, conflict, and violence.”

The fundamental shift from process to policy orientation means that the modern Finance Ministry needs to set the standards for governance and Public Financial Management (PFM) reform. They must provide evidence-based decisions and rationalize government priorities.

Which Risks Should Government Prioritize?

Public Debt

Public debt vulnerability appears central to public finance risk. It’s curious that the WEF Risk Report rates “debt crisis” as less of a risk than many, yet it appears to be somewhat centrally interconnected.

María Fernanda Espinosa, Ulrich Volz and Yuefen Li wrote in a recent article, The Debt-Climate Nexus: “Through no fault of their own, lower-income countries are teetering on the edge of an economic abyss. According to the IMF, more than a quarter of emerging economies have either defaulted or had bonds trading at distressed levels. Among low-income countries, over 60% are in or at high risk of debt distress. Governments’ failure to invest in climate adaptation and resilience measures has also worsened sovereign risk and driven up the cost of capital, creating a vicious cycle that will further cripple public finances and debt sustainability.”

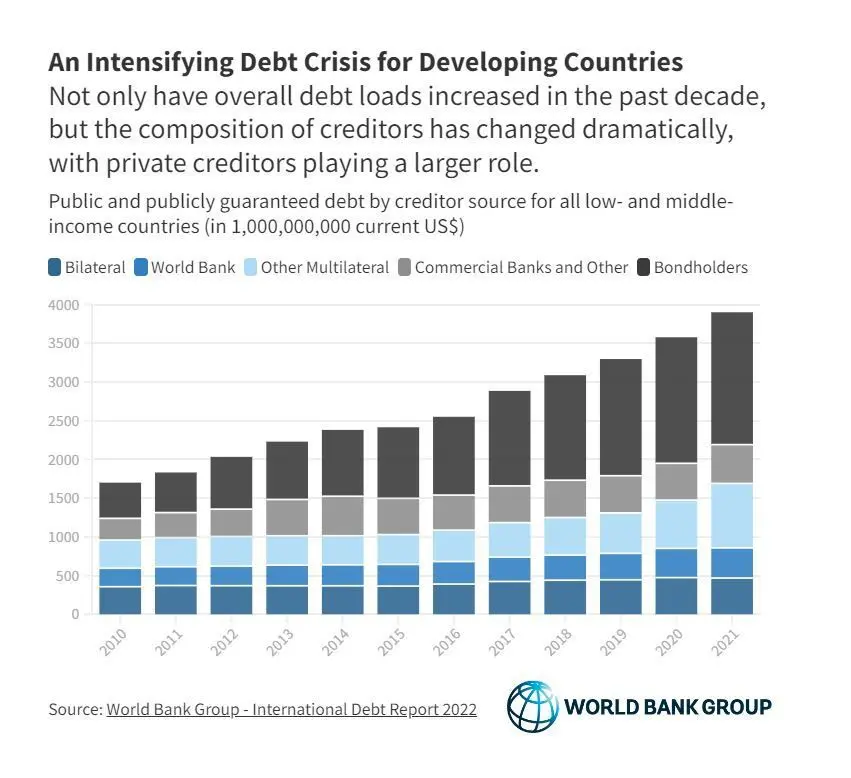

Analysis from the World Bank shows that the debt crisis is in place in developing countries is not a potential risk, it’s a current reality: “the past year saw the debt crisis facing developing countries intensify. Overall debt levels have increased for developing countries over the past decade, with some 60% of the world’s poorest countries either in debt distress or at risk of it… By the end of 2021, private creditors held 61% of the public and publicly guaranteed debt of low- and middle-income countries, according to the 2022 International Debt Report. Meanwhile, non-Paris Club countries (those who are not traditional lenders, like China, India, Saudi Arabia, and the United Arab Emirates) are playing an ever-larger role in the bilateral lending space, as well.”2

Why is Policy and Fiscal Balance Necessary During the Permacrisis Era?

The reduction of public debt has consequences. In particular: public investment trade offs. Social protection, climate adaptation, economic growth, education, health, and other public investment objectives can suffer. This requires policy and fiscal balance.

The Problem with Austerity

Governments in the coming years will have to make difficult trade offs between many competing concerns (society, security and the environment) and the need to reduce their debt burden. An analysis of 2022 trends by the World Bank found that “over-encumbered with debt, the world’s poorest are not able to make critical investments in economic reform, health, climate action, or education – among other key development priorities. Perhaps more significantly, the composition of debt has changed dramatically since 2010, with private creditors playing an increasingly larger role.”2

As Isabel Ortiz and Matthew Cummings note in their article Billions in Global South Face Looming Wave of Austerity in 2023: “the looming wave of austerity will be even more premature and severe than the one that followed the 2008 global financial crisis. An analysis of IMF expenditure projections indicates that 143 governments will cut spending (as a share of GDP) in 2023, affecting more than 6.7 billion people – or 85% of the world population. In fact, most governments started scaling back public spending in 2021, and the number of countries slashing budgets is expected to rise through 2025. With average spending cuts of 3.5% of GDP in 2021, this contraction has already been much bigger than in earlier shocks. Even more worryingly, upwards of 50 countries are adopting excessive cuts, meaning their spending has fallen below their (already low) pre-pandemic levels. This cohort contains many countries – including Equatorial Guinea, Eswatini, Guyana, Liberia, Libya, Sudan, Suriname, and Yemen – with large unmet development needs.”3

Victoria Fan and Sanjeev Gupta at the Centre for Global Development found “that low-income countries may be particularly vulnerable to reductions in domestic government health expenditure as government debt grows, and at far higher levels of debt than the Great Recession. Further, interest payments in recent years have increased, taking up a larger share of revenues and leaving less budget space for other areas. Focusing on efficiency-enhancing strategies would thus allow these countries to stretch their resources further. Initiatives for debt restructuring or additional external financing will be crucial and require political will.”4

Credit ratings firm, Moody’s, also expects environmental, social credit risks to rise in 2023.5

How Can Public Financial Management Help?

Improved PFM is not a universal cure-all to government challenges. The PFM toolkit consists of process improvements enabled by digital technology. FreeBalance’s work in PFM reform around the world over the last four decades has shown that PFM’s contribution towards government goals is as follows:

- Enabling: Specific public finance goals are achieved, such as reduced debt and improved fiscal space

- Supporting: Achievement of government outcome goals is supported by public finance such as improved social and infrastructure public investment quality

- Cross-cutting: Public finance provides underlying improvements to achieve goals such as improved spending efficiency and procurement value-for-money

- Limited: Public finance improvements have limited contribution such as enhanced public security and defence that could be associated with spending effectiveness

PFM and Risk Horizons

Modern finance ministries view risks across resilience horizons:

- Horizon 1: short-term fiscal management for stabilization and social protection

- Horizon 2: medium-term reforms focused on high risks based on the country context

- Horizon 3: longer-term resilience

These horizons can overlap based on country conditions. The move to the next horizon for some risk domains may be more rapid than others and some governments may be able to skip horizons based on current resilience. Indeed, many governments have leveraged the FreeBalance Accountability Suite™ to support resilience, across three horizons, since the pandemic.

PFM Toolkit Enables Resilience Through:

- Medium-term multiple-year planning and budgeting

- Build risk management and standardized risk matrices into budgeting

- Policy objectives integration with budgets

- Non-spending policy through regulation changes

- Fiscal early warning through interoperability of financial management systems

- Performance integration with public investments

- Spending efficiency and effectiveness

PFM Risk Horizon Approach Address Global Risks By:

Societal risks are primarily addressed through social public investments:

- Social support (stabilization)

- Vulnerability support (reduction of vulnerability)

- Equity support (gender, youth, elderly, regional, disabled groups)

Geopolitical risks are managed through PFM reform:

- Fiscal transparency (for trust and social cohesion)

- Reform lessons (many from the pandemic)

- Reform modernization (decentralization, accrual accounting, program budgeting)

Technological risks are mitigated through government digital transformation:

- Digital services (government, business, and citizen convenience and efficiency)

- Digital infrastructure (public investment)

- Digital equity (overcome the digital divide)

Public Investment can address Economic Risks through:

- Economic stabilization (business and employment support)

- Infrastructure (building and maintaining)

- Innovation (infrastructure coordination)

And Environmental Risks can be addressed by public infrastructure investments that are integrated with regulatory changes:

- Green energy (reduce fossil fuel dependency)

- Adaptation (infrastructure resilient to climate disasters)

- Mitigation (reduction in contribution to climate change)

Conclusion

For the last four decades, FreeBalance has helped governments around the world implement PFM reform to support their goals. While improved Public Financial Management does not offer a universal solution for all government challenges, it is critical nonetheless. The PFM toolkit offers governments the opportunity to manage global risks and build country resilience.

Get in touch today to find out about FreeBalance’s Modern Ministry advisory service which is available to any government.

References: