Should the International Public Sector Accounting Standards Board (IPSASB) set international public sector accounting standards for sustainability?

IPSASB and the World Bank have proposed embedding climate sustainability and natural resource assets into government accounts. (See documents1)

FreeBalance has often highlighted the linkages between Public Financial Management (PFM) and sustainability, and we firmly believe that international public sector standards should be developed.

Should professional accountants lead public sector sustainability reporting standards?

Yes, in our opinion, professional accountants should lead the effort because:

- Expenditures to achieve government outputs and outcomes is fundamental to public finance accounting

- Global and country climate change, fragility, and food security risks require government social and infrastructure investments.

- Benefits of tracking health spending and PFM for health was demonstrated during the pandemic, as was the importance of spending transparency

- Public spending integration with Sustainable Development Goals (SDGs) is necessary to achieve objectives and track progress

Should standards from the public and private sector be identical?

No, in our opinion public sector standards should be considerably different because:

- Public sector complexity, particularly in public finance with more complicated budget, accounting, and performance management structures and procedures

- Businesses have far few stakeholders (investors) than governments (citizens)

- Governments have regulatory, procurement, and taxation powers to affect sustainability, natural resources, and resilience that are significant in scope and should be accounted for

Should standards differ based on capacity?

Yes, in our opinion, some method to support capacity differences should be developed because:

- Government capacity differs widely among countries and within countries (particularly between national and subnational governments)

- Minimum compliance standard should not require accrual accounting, program and results-based budgeting PFM methods that very few governments support

- Compromised single global standards may result in something too complex for some governments, and insufficient for other governments

- Lessons from IPSAS cash and accrual reporting standards could be used with guidance on phasing in more advanced standard versions similar to cash, modified cash, modified accrual, and full accrual concepts

Should there be different standards for “sustainability” and “natural resources” accounting?

Yes, separate but complementary standards could be used because:

- Concepts of sustainability spending and natural resource value are complementary, although a clear definitions of “sustainability” and “natural resource value” are required

- Integration with SDGs and the 167 targets could be used as basic structures for both standards and a method to articulate interrelations, even post 2030

- Separation of concerns could help achieve adoption the standard most relevant to country context (such as sustainability spending in advanced economies and natural resource value in emerging economies)

Should the two-block approach be used in the public sector?

The two-block approach considers the integration between investor-focused and multiple stakeholder-focused reporting. Source: IFAC

No, in our opinion, the two-block approach should not be used, because:

- Investor focus block is critical for private sector sustainability but only partly relevant in the public sector (“investors” are a small proportion of stakeholders (bond buyers, insurers, credit agencies, PPP partners)

- Governments have far more stakeholders than businesses so stakeholder categories could be useful to consider (citizens, civil society, businesses, Development Financial Institutions, investors)

Should the “entity” approach be used?

We believe that a nuanced approach to articulating “entities” is required because:

- Entities can reflect individual Ministries, Departments, and Agencies (MDAs) and State-Owned Enterprise (SOEs) whose sustainability objectives may or may not be integrated with national objectives leading to suboptimal national reporting

- Entity sustainability spending and natural resource regulatory powers within national and sub-national governments differ

- Usage of the Classification of the Functions of Government (COFOG) could be used to articulate the sustainability and natural resource footprint of government entities while supporting government-wide reporting

- Standards could differ with higher-level accounting at the whole-of-government level with granular accounting for MDAs, SOEs, and sub-national governments based on materiality

How can Public Financial Management (PFM) and associated Government Resource Planning (GRP) financial systems support sustainability and natural resource accounting?

Public Financial Management (PFM) has adapted to modernization and standardization waves. Proposed international standards will likely be implementable while supporting improved government decision-making. However, it is possible that many custom-developed and Enterprise Resource Planning (ERP) systems will require significant customization to support these emerging standards.

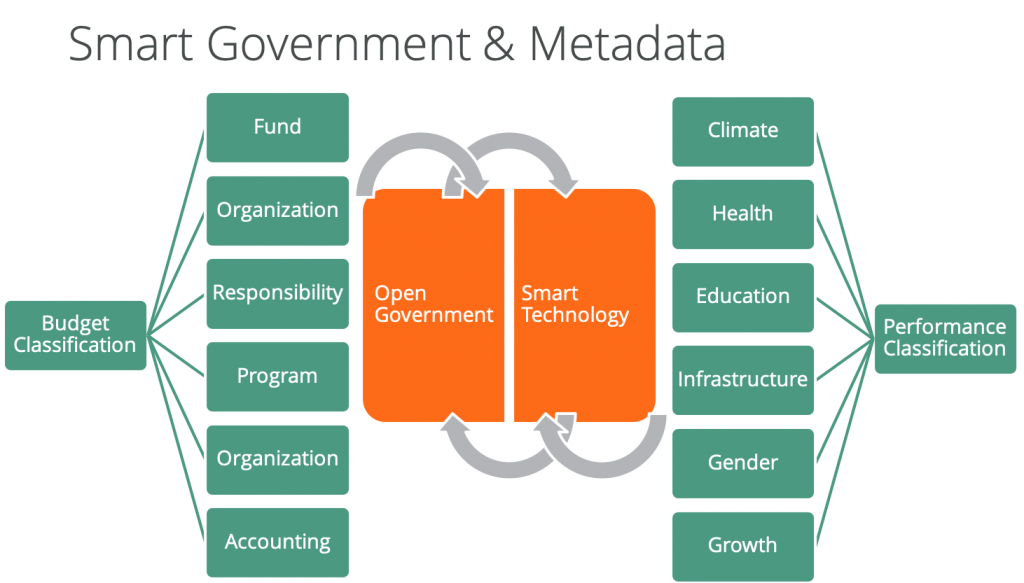

Government Resource Planning (GRP) systems, such as the FreeBalance Accountability Suite™, however are designed specifically for the public sector and are more likely to support performance budgeting, budget classification reconfiguration and progressive activation.

We see four categories that will require PFM process and financial software support:

1. Sustainability planning & implementation

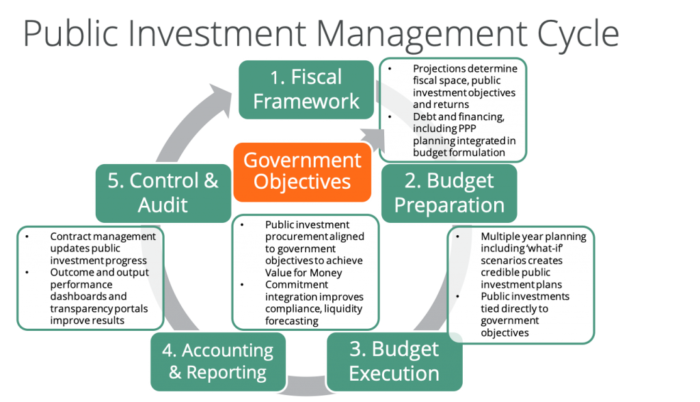

- PFM: Multiple year program and performance budgeting planning (including SDG support) integrated with public investment management processes

- GRP Chart of Accounts (budget classification) side tables with limited changes to core structures, integrated with output and outcome measurements in something like a Chart of Goals

2. Sustainability risk management

- PFM: Budget planning processes to build in risk factors as a basis for monitoring and evaluation, with fiscal risk management consistent with the Public Expenditure and Financial Accountability (PEFA) Performance Indicator 10 Fiscal Risk Reporting

- GRP: Support of “enterprise risk management” structures in budget planning that integrates with monitoring and evaluation dashboards

3. Sustainability resource consumption

- PFM: Use of Activity-Based Costing approaches to track resources used, including carbon footprint, that can be leveraged through “cost drivers” in budget planning to forecast energy and carbon usage

- GRP: Integration of budget, procurement and contract processes to track resources consumed by the supply change

4. Natural resources assets and liabilities

- PFM: Use of accrual accounting including methods to value natural resource assets, while accounting for natural resource and contingent liabilities in areas such as extractives and agriculture

- GRP: Leverage multiple-year budget preparation modelling tools, while move towards accrual accounting, extending asset and property accounting to uncover the real value of a country

What are the benefits of embedding sustainability in public finance accounting?

National development strategy alignment:

- Context-based sustainability planning and implementation through a focus on what’s critical for individual countries can improve sustainability planning and decision-making across government

Embed citizen wellbeing in public policy:

- citizen priorities, that differ among countries and communities, could be leveraged to better inform government strategy

Comparisons:

- Use of an international standard can enable comparing plans and outcomes across countries and public sector organizations to improve sustainability planning

Fiscal rules:

- Tying fiscal rules to sustainability concepts may give crisis spending flexibility while providing more effective envelopes for longer-term outcomes

Medium term approach:

- Sustainability methods could catalyze medium term approaches beyond budget ceremonies and reduce short-term political thinking

Blue bonds, green bonds, insurance:

- Ability to articulate the value of natural resources and the impact of sustainability could increase private sector financing

Role model:

- Could encourage broader adoption in the private sector, and could acts as validation to impose sustainability reporting in the private sector

Post 2030 sustainability:

- Approach potentially provides a structure for measuring public sector sustainability investments beyond the SDGs

What are the challenges of embedding sustainability in public finance accounting?

Government Capacity

- Few Emerging Markets and Developing Economies (EMDE) governments have the necessary capacity to use the foundational PFM tools for these standards including: program budgeting, Medium-Term Budget Frameworks (MTBF), performance measurement, cost accounting or accrual accounting

Potential Solutions

- National resource value could be determined by authorized third parties and tracked outside GRP systems if accrual accounting not used

- Governments could pilot MTBF exclusively for targeted social investments supporting program management and expenditure tracking before activating all social investments and phasing in multiple year planning for capital and operating expenses

Results Support

- The relative ease of tracking outputs, such as spending, and relative complexity of tracking outcomes, particularly those that accrue over time means that program budgeting does not have wide adoption among EMDEs – most of the implementations seem to be ceremonial (based on PEFA assessments)

Potential Solutions

- Minimal compliance level of tracking on spending outputs that could be extended to output tracking from procurement contracts (what the spending bought), and then to outcomes

- As described in the previous section on capacity, program budgeting could be rolled out initially with high-priority social spending subsets

Outcome Statistical Support

- Many countries do not track sustainability or wellbeing statistics

Potential Solutions

- Statistical data collected by International Financial Institutions and International Non-Profit Organizations2 could be leveraged to support high-level outcome measures

- Many of the 169 SDG targets are proxy measurements that can be tracked outside of public finance systems

- Governments could develop pilot intermediate performance outcome measurements building on program budgeting pilots

Value-for-Money Cost

- The cost benefit for full accrual accounting that may be necessary to fully support sustainability and natural resource accounting may not be justifiable in many governments

Potential Solutions

- Governments could build natural resource models based on international guidelines and track changes year-by-year in separate sub-ledgers in much the same way that some track fixed asset value and depreciation without updating cash-basis General Ledgers

- Spending data on sustainability spending could be accrued at fiscal year ends, using modified cash mechanisms and built-in accounting system reporting

- Overall benefits of adopting full accrual accounting could be more demonstrable though pilots using sustainability and natural resource accounting

Materiality

- It could be difficult to establish government-context materiality for what ought to be tracked in public finance systems

Potential Solutions

- Governments have realized that some SDGs are more important than others based on country context – this approach could be leveraged post-2030

- Materiality guidelines in templates could be developed by IPSAS for government implementation

Established Models

- The many models2 from many sources for sustainability reporting adds levels of complexity that may be difficult to rationalize, especially when conceptually integrated with many different IPSAS standards (1, 11, 19, 21, 26, 413)

Potential Solutions

- Governments could decide to use more than one reporting method if using systems that have flexible side tables or reporting objects that leverage detailed Chart of Accounts data

- IPSAS could provide a set of standards that map to different sustainability standards

- Other IPSAS standards could be used as guidelines, each with some narrative explaining how to use effectively and mapped back to the new

What are the challenges that will be very difficult to overcome?

Resource Management Tracking

The tracking of government energy, resource, and carbon usage does not appear to be part of these discussions also the public sector is a significant contributor to green house gases

Difficult Solutions

- Use of procurement contract management for supply chain consumption – relying on private sector capabilities that may not be present, while increasing prices because of the extra management burden

- Assets and fleet usage reporting (i.e. amount of fuel used by vehicles & type of vehicles in public infrastructure projects, carbon footprint in inventory locations, water usage in public buildings) – requiring complicated tracking methods

- Leverage Environmental Social and Governance (ESG) disclosure standards like the Global Reporting Initiative (GRI) – likely requiring adjustment of sector and topic standards for relevance

Natural Resource Value

What natural resources should be valued? All natural resources, or only those natural resources untouched by humans?

Difficult Solutions

- Limit value calculations to “natural occurring resources” that are “not subject to human intervention” as suggested in an IPSAS Consultation Paper Natural Resources – that may be relatively easy to calculate, but surely does not measure the true natural resource value for extractives, agriculture, fisheries, and forestry industries that have had some human intervention

- Leverage guidelines, perhaps implemented by third-parties, to value natural resources as described in a 2017 IMF paper: Guide to Analyze Natural Resources in National Accounts – that is limited to metals, ores and minerals rather than the full picture

- Extended use of fixed asset concepts to real property and heritage assets – that adds significant and expensive complexity through valuation and revaluation because many these assets will appreciate in value

Political Impediments

Global political environment includes climate change denial and populism on one hand, and the view that EMDEs should be permitted to leverage environmental resources to achieve growth, on the other hand. There is a lack of trust in governments, making implementation of either standard politically polarizing in many countries.

Difficult Solutions

- Monitor and debunk disinformation sources – shown to be generally ineffective on social media, subject to state propaganda, and considered to restrict freedom of expression by many

- Build political acceptance through finance ministry modernization as described in the 2015 IMF paper: The Evolving Functions and Organization of Finance Ministries with “a broader focus on strategic policy issues” – requiring a significant change in most MoFs from compliance to strategy management, and the need to decentralize routine functions to line ministries that may not have required capacity

Takeaways

- A cost-benefit analysis will be helpful to identify what elements of sustainability reporting and natural resource valuation represents the best value-for-money in governments

- Simple base standards for sustainability reporting and natural resource valuation could be implemented to support low to high capacity governments, with guidelines for extending based on country context

- Sustainability spending, resource usage, and natural resource value can be embedded into government accounts

- Advanced PFM practices such as: program budgeting, performance management, activity-based costing, and accrual accounting will be helpful to achieving standards

Background

Documents1

- IPSASB Advancing Public Sector Sustainability Reporting

- IPSASB Natural Resources Consultation Paper

- World Bank Sovereign Climate and Nature Reporting: Proposal for a Risks and Opportunities Disclosure Framework

- IPSASB Staff QA Climate Change Relevant Guidance

- IFAC Sustainable Development Goals Disclosure (SDGD) Recommendations

Selected sustainability outcome sources2

- United Nations World Happiness Report with measures for GDP per capita, social support, generosity, life expectancy at birth, freedom of life choices, corruption perception with country scores

- Wellbeing Economy Alliance Happy Planet Index with measures for wellbeing, ecological footprint, and life expectancy with country scores

- United National Sustainable Development Goals with 169 targets with country profiles

- Oxford Poverty and Human Development Initiative at the University of Oxford and the Human Development Report Office of the United Nations Development Programme Multidimensional Poverty Index with country scores

- Legantum Prosperity Index with “12 pillars of prosperity split into 67 discrete policy focussed elements, and grouped into three domains essential to prosperity: Inclusive Societies, Open Economies, and Empowered People” with country scores

- Social Progress Imperative Social Progress Index for beyond GDP with 12 measures in 3 categories and country scores

IPSAS standards3