What Causes Government Financial Management System Failure?

The failure rates of government Financial Management Information System (FMIS) implementations are high. But that doesn’t mean the problems can’t be overcome. All that is required is a proper understanding of why government financial management systems fail.

FreeBalance has been implementing these systems in mature, emerging and fragile states around the world for almost 40 years. These experiences have led to a comprehensive analysis of the root causes of FMIS implementation failures – which we share freely in line with our purpose-driven mandate of enabling PFM reform that matters.

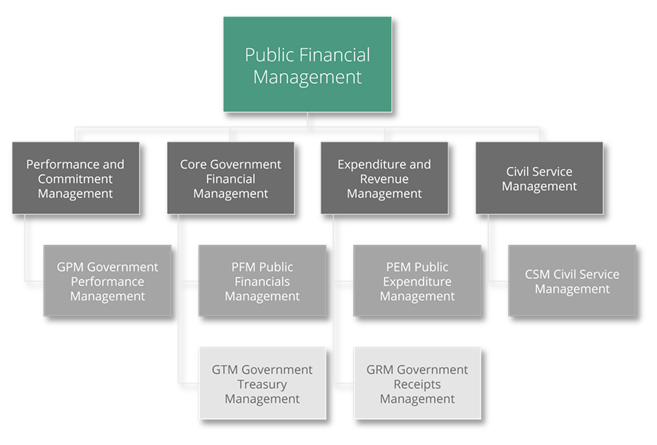

What is a Government Financial Management System?

A FMIS, or what we call Government Resource Planning (GRP) system, is either a custom-developed or Commercial-Off-The-Shelf (COTS) suite of software that automates the government budget cycle and is integrated with non-financial functionality such as human resources with payroll. It is an integrated, unified system that enables a government to perform its Public Financial Management (PFM) functions.

Good PFM is associated with good governance, transparency and accountability – all important characteristics if a government wants to build trust, attract foreign aid / investment, and elevate its standing in the international community.

Did You Know?

FreeBalance customers score better in their PEFA assessments, our implementations have higher success rates, and our software costs less?

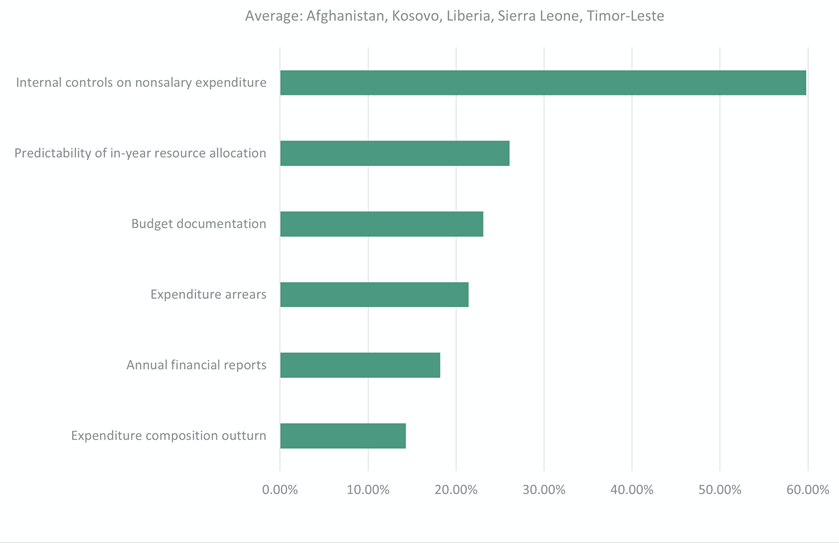

FreeBalance Customer PEFA Results

FreeBalance customers have achieved an average 27%* improvement in key PFM performance indicators as measured by the independent PEFA program.

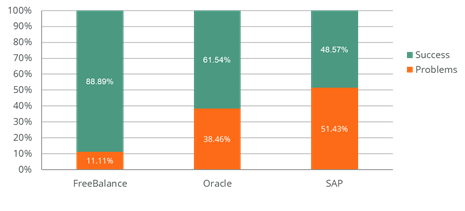

Global GRP Success Rates

FreeBalance has much higher reported success rates than SAP and Oracle – despite the fact that more than ½ of our implementations are in very difficult circumstances while the majority of competitor implementations are in countries with high human capacity.

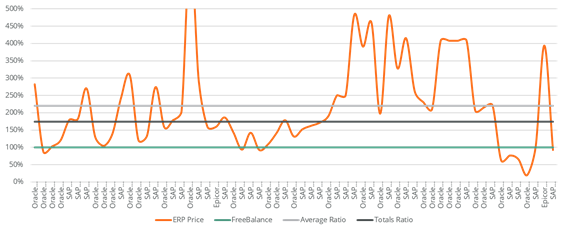

Five Year Total Cost of Ownership

Five year total cost of ownership including software, middleware, implementation, training & support, and in some situations, servers. The grey line compares the average ratio per bid for ERP solutions – about 225% FreeBalance price. The black line compares the total price for all ERP and all FreeBalance bids – ERP at 175% of FreeBalance price.

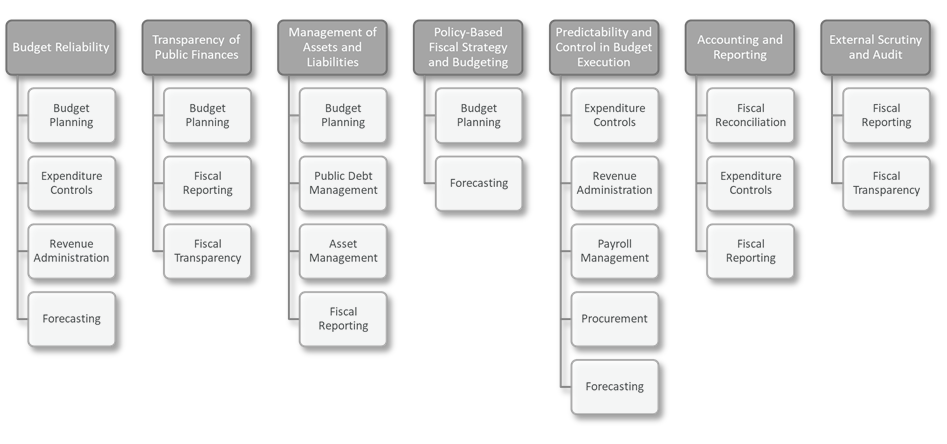

How Does a GRP System Help PEFA Assessments?

A robust and effective FMIS is also an important tool for governments concerned with improving their Public Expenditure and Financial Accountability (PEFA) assessments. GRP automation assists with many of the PEFA Framework’s requirements:

- Budget reliability (PI-1 to PI-3)

- Public access to fiscal information (PI-9)

- Public asset management (PI-12)

- Public debt management (PI-13)

- Predictability and control in budget execution (PI-19 to PI-25)

- Accounting and reporting (PI-27 to PI-29)

PEFA measures the outputs and outcomes from people, processes and practices supported by GRP technology and so it is important that a GRP system should help – not hinder – governments improve fiscal stewardship across all eight PEFA pillars.

The technology contribution differs across the measures, but aspects of GRP software that are particularly relevant to government fiscal management are:

GRP Contribution to Good Governance

- Budget Planning with workflow and analysis enables credible budget plans, transparent budget documents, public investment and capital budget plans, while supporting multiple year policy-based approaches

- Expenditure Controls managing commitments and obligations enables budget-execution-to-plan consistency, budget execution control and predictability, and government accounting

- Revenue Administration handling tax and non-tax revenue enables revenue reporting, and tax mobilization

- Public Debt Management when integrated with other GRP components enables liquidity and liabilities management

- Asset Management including investment, fixed and capital assets enables asset optimization

- Payroll Management when integrated with human resources and financial systems enables salary predictability and control, which is often the largest expenditure for many governments

- Procurement when integrated with commitment controls enables value for money management for budget execution control, an important consideration given that some governments spend around 20% of country GDP on procurement

- Fiscal Reconciliation through payment, bank, suspense accounts, revenue and expenditure integration enables accurate and effective reporting and can improve liquidity

- Fiscal Reporting enables timely statutory and transparency reporting, timely and accurate reporting on the government fiscal position with quarterly and annual reports that support audit and scrutiny

- Fiscal Transparency driven from GRP data enables budget transparency, audit and scrutiny

- Forecasting with scenario planning built on GRP data enables budget plan accuracy, policy-based analysis, and revenue and expenditure predictability

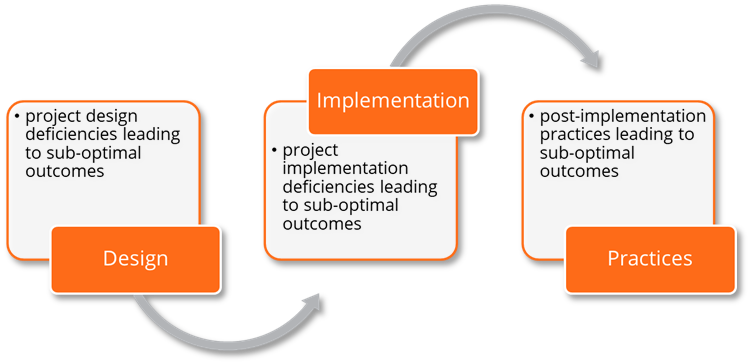

Why FMIS Projects Fail

Technology is only part of the solution. The best possible technology can be implemented poorly. Unfortunately, people, process and practice elements are at play…

We have identified a range of problems which occur regardless of the IT solution selected.

Project Design

Project concept and design often contribute to poor GRP outcomes.

Problems include:

- Requirements Disconnect: Hiring external experts to produce tender documents who are unfamiliar with the country context fail to diagnose real needs or follow personal biases on what should be important

- Best Practices Mimicry: Specifying the use of so-called “best practices” that are inappropriate for government capacity, do not match government legislation or are solutions to problems that governments do not have

- “Paving Cow Paths”: Specifying processes as they are rather than rethinking based on modern automation

- Poor Sequencing: Following a PFM reform sequence that does not match the government context of what (budget execution, budget planning, revenue mobilization, public investments, procurement, payroll, and audit reform) will have the largest positive effect given capacity constraints

- Reform Fatigue: Envisioning unrealistic numbers of process and legal reforms combined with installing too many financial modules

- IT Focus: Seeing GRP primarily as an information technology concern, rather than as reform and transformation

- Technical Focus: Seeing GRP primarily as a finance ministry technical concern, rather than something that will need to roll out across the whole of government

- Lack of Coverage: Building GRP based on finance ministry needs rather than the PFM needs of ministries, agencies, departments, sub-national governments, and parastatals

- Rigid Project Management: Building unrealistic milestones and rigid waterfall style processes rather than recognizing that original specifications are likely faulty, and agile processes are often more effective

- Status Fallacy: Favouring and selecting large Commercial-Off-The-Shelf (COTS) software manufacturers and large systems integrators, with the false belief that this will advance the perceived status of the government

- Governance Structure Disconnect: Dealing indirectly with COTS software manufacturers through systems integrators who may not understand the chosen software in the government context, or who may seek to increase revenue through customization and frequent change orders

- Rip and Replace Many Systems: Implementing a single solution designed to replace multiple systems (often in the hundreds with limited integration) with the view that all sorts of efficiency will be achieved ignoring the special nature and workflow of many of the systems

Project Implementation

Inadequate GRP implementation practices often contribute to government financial management failure.

Problems include:

- Lack of Political Will: Expectations that the software will ‘just happen’ with limited insight from political leadership; no fully dedicated staff, no qualified staff, or significant staff government project team turnover

- Mismatched Incentives: Mismatching incentives with success such as rewarding public servants if schedules are met (e.g., sign-off occurs even when test cases fail) or rewarding public servants to find fault with vendors (e.g., fining vendors even when test cases succeed)

- No PFM Knowledge: Hiring implementation consultants who understand technology and products but have no government or PFM expertise

- Poor Change Management: Assuming that users will use GRP software after rollout; or that organizational change management is something done at project kickoff and through periodic newsletters

- Inappropriate Capacity Building: Building capacity through product training without PFM, project, or IT training and mentoring – which can be further complicated when training is provided by those who are unfamiliar with the PFM domain

- Lack of Integration and Interfaces: Integrating with required subsystems through manual methods or poor integration practices

- Ineffective or Disconnected Budget and Accounting Classifications: Creating charts of accounts classifications that are not consistent with government data needs, do not support international standards, are different between budget and accounting classifications, or not supported in subsystems like payroll and procurement

- Disintegrated Controls: Attempting to duplicate and maintain commitment, segregation of duties and approval controls across systems; or subsystems that have no government controls

- Process Complexity: Building processes that require too many stages of approval and does not reflect inherent risk and civil service capacity

- Legal Framework Fallacy: Customizing GRP to run antiquated processes on the mistaken view that any change will require legal reform

- Ineffective Reports: Developing reports that are not exception-based, predictive, or reflect government concerns such as budget and cash availability

- Late Change Orders: Expecting that changes to software can be accomplished very late in projects

- Highest Paid Person: Decision making based on the opinion of senior government or project staff that takes precedence over facts and insights from more qualified staff

- Schedule Slavery: Following the original schedule to the detriment of user training, acceptance testing, and low-cost implementation improvements

- Late Sign-Off: Delaying milestone approvals that cascade throughout the project which leads to change resistance

Post-Implementation Practices

Inadequate GRP use practices often contribute to poor GRP outcomes.

Problems include:

- Poor Legal Framework: Operating GRP systems based on outdated legal frameworks that introduce poor practices, particularly in controls

- Practice Does Not Follow Process: Working around legal frameworks and good practices (e.g., sharing passwords) to circumvent segregation of duties; using incorrect account codes for expenditures rather than requesting budget transfers; splitting acquisitions to fall under public procurement minimums; or payments handled outside the system

- Recording Not Controlling: Utilizing the GRP system as a system of record for transactions that have already occurred, leading to workarounds and inaccurate data

- Distrust and Duplication: Duplicating GRP transactions with paper because the system is distrusted or there are job concerns, leading to efficiency reduction

- Incredible Budgets: Developing budgets that are not credible, resulting in frequent budget transfers, supplemental budgets and working around commitment controls

- Government Priorities Disconnection: Creating budgets and expending funds based on departmental concerns rather than on government priorities like national development strategies and visions

- Staff Turnover: Losing qualified staff to other ministries or the private sector

- Government Silos: Attempting to manage public finances when there strong and uncooperative organizational units for functions such as debt, taxation, public investments and payroll

- Over-Centralization or Over-Decentralization: Managing public finance processes too centrally such as approving every commitment in the finance ministry, or too de-centrally such as providing budget transfer discretion when there is not sufficient capacity

- Political Interference: Changing spending priorities based on short-term political thinking such as for re-election campaigns

- Lack of Transparency: Limiting disclosure of priorities, budgets, spending, revenue, and procurement or public investments within government and with the public that limits accountability

- Ignoring Evidence: Making decisions based on dogma or past thinking contrary to clear information from GRP systems

- Poor Forecasting: Managing public finances without scenario planning or adequate forecasting for potential commitment overages, liquidity requirements, salary changes, currency fluctuations, trade tensions, and natural disasters

- Poor IT Infrastructure: Hosting GRP technology with inadequate server capacity, limited fault tolerance, lack of patching, legacy technology, or poor IT management practices

- Sunken Cost Fallacy: Continuing to invest time and money into GRP systems that can not adapt to real government requirements, future reforms, or public service capacity

- Cash-Based Vulnerabilities: Using the cash basis for accounting which can hide transactions, often increasing payment arrears

- Cash and Budget Disconnect: Managing expenditures based on cash availability, or managing expenditures based on budgets that have no integration with actual liquidity compromises cash planning and budget reliability

Further Help from FreeBalance

FreeBalance offers a range of advisory services that are customized for governments and include the identification of PFM reform sequencing based on priorities, modernization of institutional structures, operating systems and mandates, and policy and budget alignment to citizen wellbeing and sustainable development.

- Advisory Services

- Governance

- Modern Ministry

- Government Resource Planning

- Smart Prosperity

- Pandemic Response

- Implementation Services

- Project Preparation

- Country and Government Analysis

- Technology Analysis

- Project Governance

- Product Governance

- Sustainability

- Sustainability Services

- Capacity Building

- Capacity Enhancement

- Product Maintenance

- Solution Support

Get in touch to set up a personal conversation around how FreeBalance can help your country’s PFM reform journey.

.warning-table { padding: 25px; border: 2px solid #f36b22; border-radius: 4px; } .w-75 { width: 75%; text-align: center; margin: 0 auto; margin-bottom: 30px; } .double .wp-block-column { width: 50%; display: inline-flex; } .wp-block-column ul li { padding-bottom: 0px; margin-bottom: 0px} .has-text-align-center { text-align: center; }