Public Financial Management (PFM) ‘good practices’ supported by effective Government Resource Planning (GRP) systems such as the FreeBalance Accountability Suite™ helped countries to better manage pandemic spending. That was the conclusion of the second blog entry in this series:

- What is the heart of country resilience?

- What is the brain of country resilience?

- How can governments transform country resilience?

This blog entry explores teachable PFM moments from the pandemic.

How to Support Country Resilience with PFM Good Practices

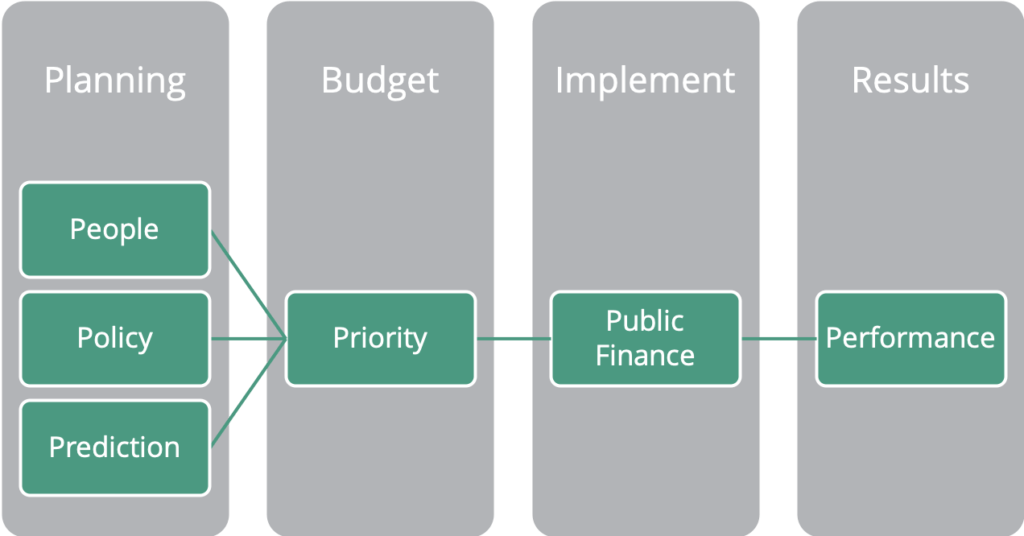

To expand on this ‘PFM for Resilience’ concept introduced in the previous blog entry, the budget cycle offers resilience planning and tracking opportunities.

1. Planning

People First

- Identify citizen wellbeing priorities because resilience has significant cultural context

- Identify more vulnerable populations who will need more support in the event of a disaster

- Utilize program budgeting concepts to tie national priorities to government organizational plans showing spending by purpose and location

Policy

- Embed wellbeing into national accounts

- Take a more nuanced view of growth, using the lens of the Sustainable Development Goals (SDGs)

- Build in contingency funds

Prediction

- Analyze country risks, using the lens of the annual Global Risk Report, and analyzing trends

- Leverage scenario “what-if” analysis during budget planning

- Create models for these scenarios that show potential knock-on effects in revenue and spending that can be leveraged quickly during budget implementation

2. Budgeting

Priorities

- Ensure organizational spending plan alignment to national goals, particularly for public and social investments

- Leverage prioritization, and changes in priorities, to increase, reduce, or eliminate spending in low-priority programs

- Implement results-based budgeting as hypothesis of what resilience outputs and outcomes can be achieved beginning with key priority sectors such as health or climate adaptation

3. Implementation

Public Finance

- Leverage contingency funds when necessary

- Provide early spending and revenue warning to predict potential fiscal pressures

- Leverage scenarios developed during planning, using up-to-date information, to re-forecast potential impacts

- Create managerial and ministerial dashboards and alerts to support exception-based analysis

- Reallocate funds and adjust controls

- Provide automated fiscal transparency

4. Results

Performance

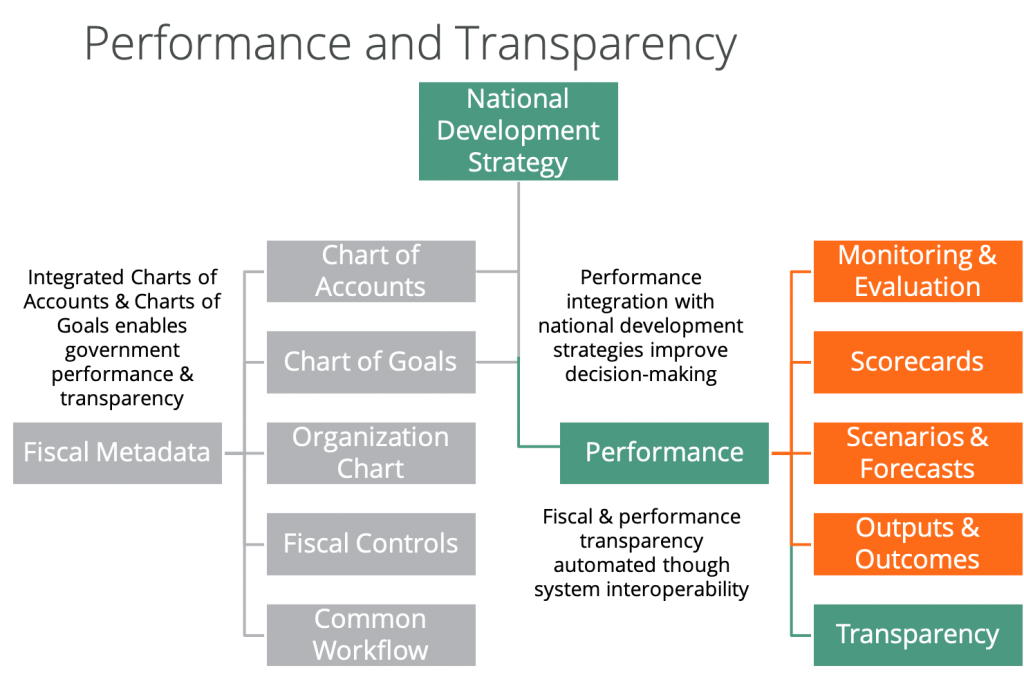

Performance is more difficult to manage in government than business. Businesses have a bottom line to understand whether performance metrics are relevant. In other words, a private sector outcome measurement like customer satisfaction or churn rate can be directly associated with profit or loss. Meanwhile, governments focus on outputs and outcomes. Governments are faced with the conundrum of determining which outcome to measure and whether targets are relevant.

Effective government performance management improves planning and budgeting – as provided for in the FreeBalance Accountability Suite™.

Key Government Performance Management Lessons

The World Bank developed a Disaster Resilient and Responsive Public Financial Management framework consisting of eight pillars. This is important resilience insight that can be extended beyond disaster resilience to other fiscal risks. These pillars inform PFM reform and transformation.

Technical PFM Lessons

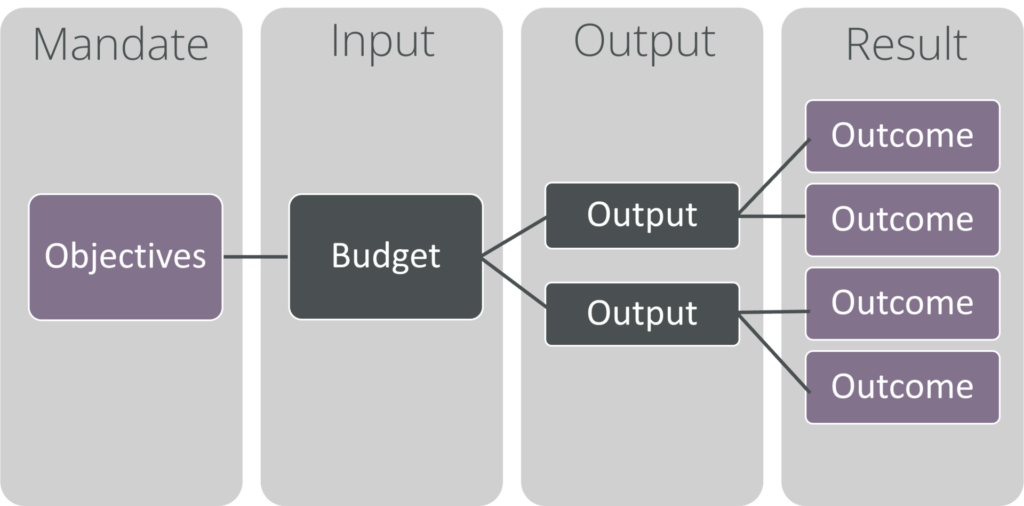

Performance Budgeting

The support for program budgeting was without a doubt the most important lesson learned. Performance budgeting allows governments to:

- Support tracking of expenditures by purpose across all government Ministries, Departments, and Agencies (MDAs) – such as health spending, cost per unit, winning bidders, locations, usage

- Represent the key reform to plan and track priorities, including resilience and the SDGs

- Support intermediate linkages with outputs

- Form the foundation for performance management because results accrue through the activities of many programs

Performance budgeting supports effective planning for disaster risk management (DRR-PFM Pillar 3) and disaster-informed public investment and asset management (DRR-PFM Pillar 4) supporting institutional arrangements (DRR-PFM Pillar 1).

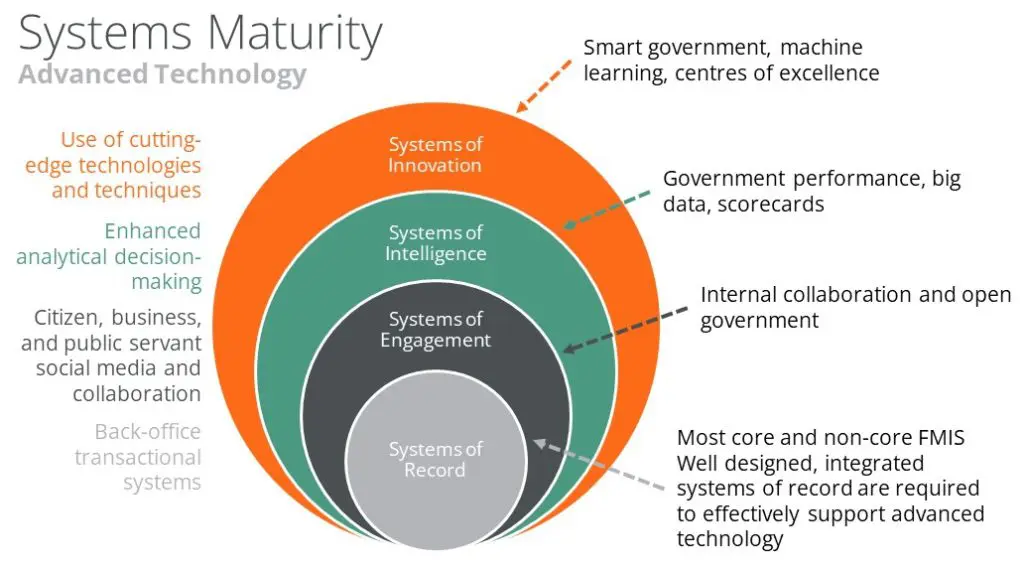

Transformation

Governments adopted digital technologies during the pandemic increasing automation. This digitization helped improve service delivery, but was not necessarily digital transformation. That’s because digital transformation is about rethinking processes based on the capabilities of digital technology. The pandemic lesson is that there are effective government performance “north stars” to consider:

- United Nations World Happiness Report with measures for GDP per capita, social support, generosity, life expectancy at birth, freedom of life choices, corruption perception with country scores

- Wellbeing Economy Alliance Happy Planet Index with measures for wellbeing, ecological footprint, and life expectancy with country scores

- United National Sustainable Development Goals with 169 targets with country profiles

- Oxford Poverty and Human Development Initiative at the University of Oxford and the Human Development Report Office of the United Nations Development Programme Multidimensional Poverty Index with country scores

- Legantum Prosperity Index with “12 pillars of prosperity split into 67 discrete policy focussed elements, and grouped into three domains essential to prosperity: Inclusive Societies, Open Economies, and Empowered People” with country scores

- Social Progress Imperative Social Progress Index for beyond GDP with 12 measures in 3 categories and country scores

This transformation approach aligns with the foundation of World Bank DRR-PFM, Pillar 8, social inclusion. As described in the World Bank blog entry:

“Be inclusive: Governments can identify the needs of different segments of the population and address these needs in plans, budgets, and program implementation in response to disasters. Collection and analysis of disaggregated data plays a key role in understanding social inclusion gaps and informing the policy design.”

Digital transformation done right has great potential to promote inclusion and social equality.

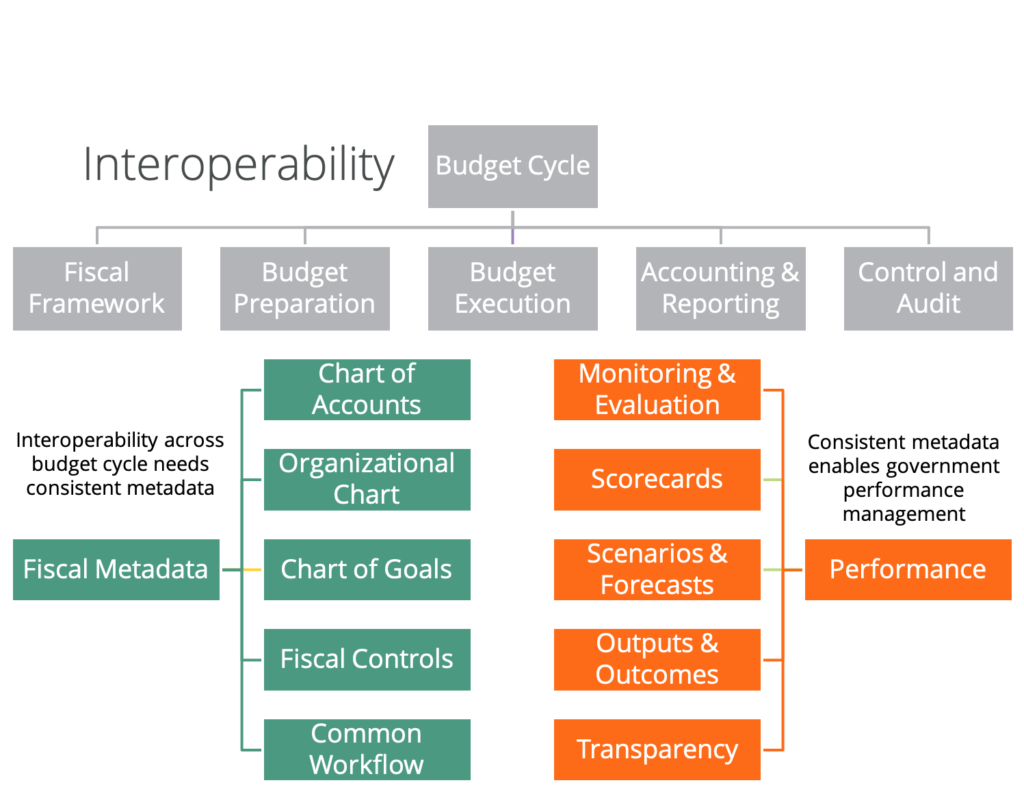

Technology

FreeBalance customers were able to leverage configurability in Government Resource Planning (GRP) technology to react to pandemic fiscal pressure volatility. The need for interoperability among all government financial systems is a more important resilience lesson. Interoperability:

- Enables effective decision-making through a “single version of the truth” with consistent metadata across applications

- Ensures commitment controls and segregation of duties are consistent among applications

- Automates electronic transparency for budgets, procurement, tax administration, public investments, salaries, recruitment

Effective technology aligns with World Bank DRR-PFM:

- Pillar 2 resilient information systems and records

- Pillar 5 budget management, controls, and reporting

- Pillar 6 disaster responsive public procurement

Transparency

There were few examples of good pandemic communications by governments. Many officials attempted to communicate assertively in a state of uncertainty. This led to corruption suspicion and reduced trust in government. Fiscal transparency demonstrates progress when there is progress. For example, fiscal transparency across the health supply chain can be automated with integrated GRP systems:

- Budget planning transparency: Spending and procurement plans in annual budgets that form commitment controls

- Budget execution transparency: Changes in controls, contingency funds usage, supplemental budgets, virements and budget transfers

- Acquisition transparency: eProcurement, fixed assets, inventory, consumption outputs

- Spending transparency: social programs, salaries, overtime, operational costs in addition to acquisitions

- Audit: financial, compliance and performance auditing to improve PFM processes

Effective transparency aligns with World Bank DRR-PFM:

- Pillar 2 resilient information systems and records to automate transparency

- Pillar 5 budget management, controls, and reporting to automate transparency reporting

- Pillar 6 disaster responsive public procurement for transparent e-procurement

- Pillar 7 disaster responsive audit and oversight

Trust

Improvements technical PFM, technology, transparency, and the transformation of policy all lead to improved trust and social cohesion:

- Spending actions are visible and ready for oversight

- Priorities are well-articulated

- Fiscal information is less subject to manipulation, more timely, and more accurate

- Service delivery outputs and outcomes are improved, especially for social and public investments

In other words, transparent governments who provide excellent citizen services are more trusted.

How Can Governments Elevate PFM to Achieve Resilience?

Short answer: finance ministry modernization

Modern finance, economic, and planning ministries provide policy and risk management services. These ministries evaluate MDA proposals through scenario analysis. Routine financial tasks are decentralized to focus on meaningful budget integration with government priorities.

Among the characteristics of effective modern finance ministries are:

- Leverage technology effectively

- Default for transparent fiscal information

- Focus beyond GDP growth to resilience and social cohesion

- Utilize risk planning, monitoring, and evaluation

- Consulting with MDAs to better achieve national development strategies

FreeBalance, as a PFM specialist, provides advisory services to all governments regardless of what financial software it is operating. The FreeBalance Modern Ministry Service is part of the A-i3+qM methodology that includes transformation:

- Manage organizational change

- Create development policy

- Develop public policy

- Develop national development strategies

- Coordinate aid with donors

- Build civil service knowledge and capacity

- Decentralize processes and systems

- Manage reform and modernization

- Business process engineering

- Automate government processes

- Support government fiscal transparency

- Develop performance measurements

- Implement multiple year budget planning

- Monitor cash, debt, revenue, expenditures, assets, investments

To speak to a Public Financial Management expert, please get in touch.